Sentiment: Bearish

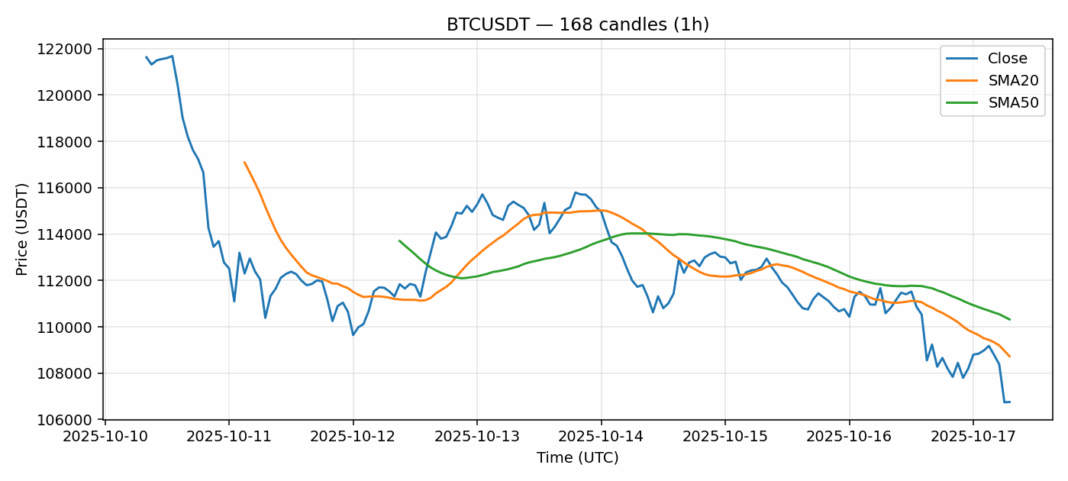

Bitcoin is showing concerning technical signals as it trades at $106,752, having declined 4.4% over the past 24 hours. The current price sits below both the 20-day SMA ($108,727) and 50-day SMA ($110,317), indicating bearish momentum in the near to medium term. The RSI reading of 37.87 suggests Bitcoin is approaching oversold territory but hasn’t yet reached extreme levels that typically signal a reversal. Trading volume remains substantial at $3.46 billion, indicating active participation in this downward move. The elevated volatility at 2.6% reflects heightened market uncertainty. For traders, this setup suggests caution – consider waiting for a confirmed bounce from oversold conditions before entering long positions. Short-term traders might look for resistance around the $108,000 level for potential short entries, while longer-term investors could view dips toward $105,000 as accumulation opportunities. Monitor for potential support establishment around current levels.

Key Metrics

| Price | 106752.2900 USDT |

| 24h Change | -4.42% |

| 24h Volume | 3463586115.81 |

| RSI(14) | 37.87 |

| SMA20 / SMA50 | 108727.48 / 110317.16 |

| Daily Volatility | 2.60% |

Bitcoin — 1h candles, 7D window (SMA20/SMA50, RSI).