Sentiment: Bullish

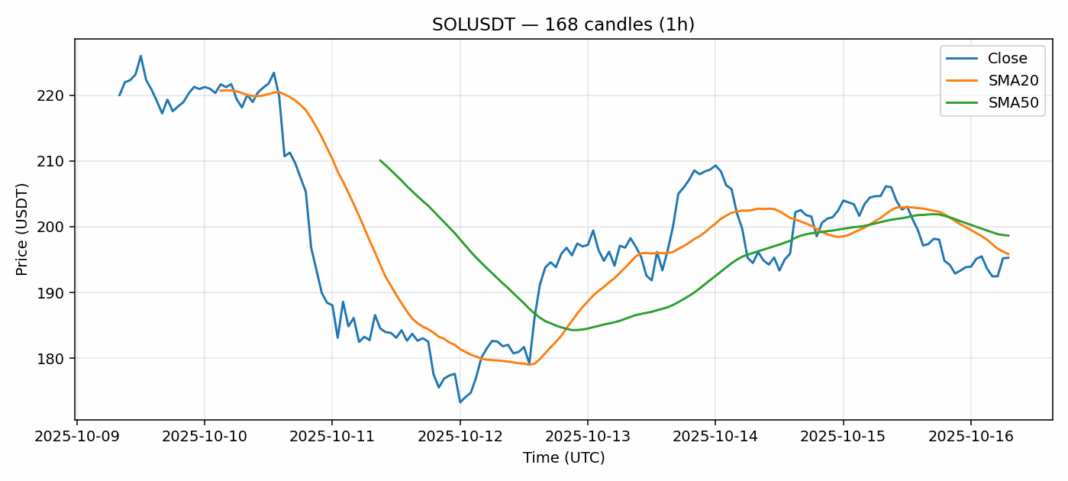

SOL/USDT is showing signs of consolidation after recent selling pressure, currently trading at $195.27 with a 4.5% decline over the past 24 hours. The RSI reading of 39.5 indicates the asset is approaching oversold territory, which could present a potential buying opportunity for swing traders. Volume remains robust at over $1 billion, suggesting continued institutional interest despite the price dip. The current price sits just below the 20-day SMA of $195.85 but remains above key psychological support at $190. With volatility elevated at 5.6%, traders should expect continued price swings. For position traders, accumulating near current levels with stops below $185 could offer favorable risk-reward. Day traders might look for bounces off the $192-194 support zone targeting resistance around $205. The technical setup suggests we’re in a corrective phase within a broader uptrend, making this an attractive entry point for patient investors.

Key Metrics

| Price | 195.2700 USDT |

| 24h Change | -4.54% |

| 24h Volume | 1001621463.25 |

| RSI(14) | 39.52 |

| SMA20 / SMA50 | 195.85 / 198.65 |

| Daily Volatility | 5.63% |

Solana — 1h candles, 7D window (SMA20/SMA50, RSI).