Sentiment: Neutral

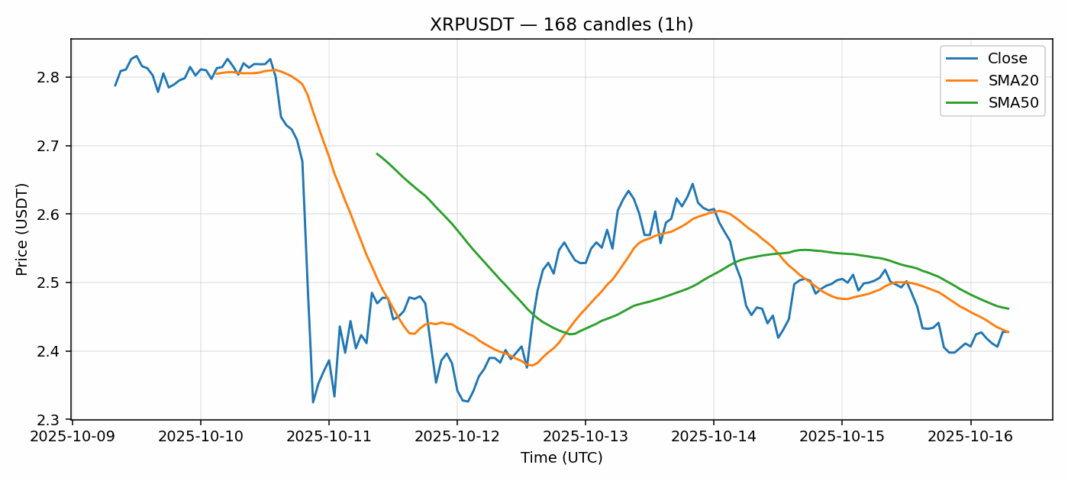

XRP is showing consolidation patterns around the $2.43 level after a modest 2.99% pullback over the past 24 hours. The current price sits almost exactly at the 20-day SMA ($2.428) but remains below the 50-day SMA ($2.462), indicating near-term resistance overhead. Trading volume remains substantial at $386 million, suggesting continued institutional interest despite the slight downturn. The RSI reading of 47.68 shows XRP is neither overbought nor oversold, leaving room for movement in either direction. With volatility measured at 5.9%, traders should expect continued price swings. For active positions, consider setting stop-losses below $2.35 while targeting resistance near $2.50. The convergence around key moving averages suggests we’re at a critical inflection point – a break above $2.46 could signal renewed bullish momentum, while failure to hold $2.40 may trigger further selling pressure. Monitor SEC-related developments closely as regulatory clarity remains the primary catalyst for XRP price action.

Key Metrics

| Price | 2.4279 USDT |

| 24h Change | -2.98% |

| 24h Volume | 386561048.55 |

| RSI(14) | 47.68 |

| SMA20 / SMA50 | 2.43 / 2.46 |

| Daily Volatility | 5.91% |

Ripple — 1h candles, 7D window (SMA20/SMA50, RSI).