Sentiment: Neutral

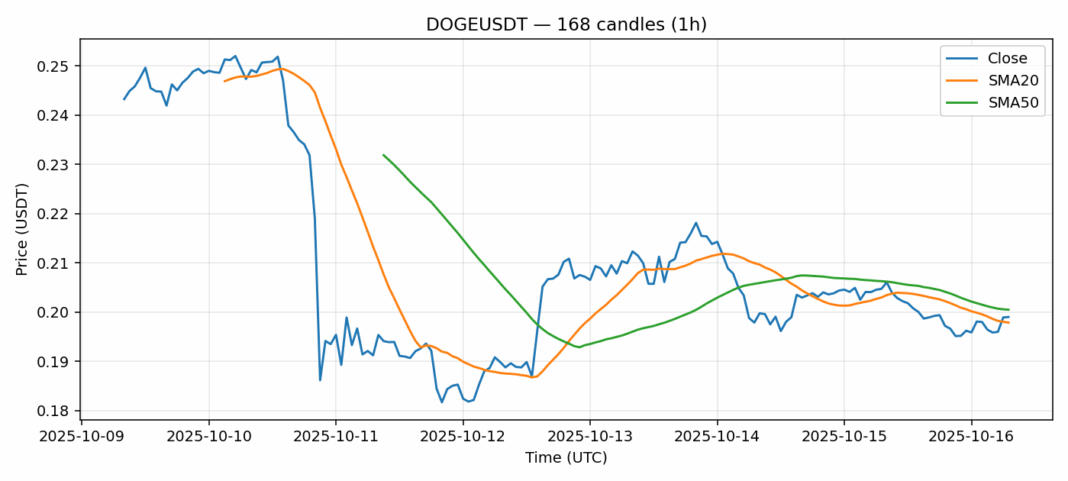

DOGE is showing consolidation around the $0.199 level after a modest 2.6% pullback over the past 24 hours. The current price sits just above the 20-day SMA at $0.198 while remaining below the 50-day SMA at $0.200, indicating near-term indecision in the market. Trading volume remains substantial at $281 million, suggesting continued institutional and retail interest despite the slight downturn. The RSI reading of 49.14 sits in neutral territory, neither overbought nor oversold, providing room for movement in either direction. With volatility at 9%, traders should expect continued price swings. For position traders, holding support above $0.195 appears crucial for maintaining bullish momentum. Short-term traders might consider range-bound strategies between $0.195-$0.205 until a clear breakout direction emerges. The current setup suggests waiting for a decisive break above the 50-day SMA before adding long positions.

Key Metrics

| Price | 0.1990 USDT |

| 24h Change | -2.59% |

| 24h Volume | 281033839.84 |

| RSI(14) | 49.14 |

| SMA20 / SMA50 | 0.20 / 0.20 |

| Daily Volatility | 9.03% |

Dogecoin — 1h candles, 7D window (SMA20/SMA50, RSI).