Sentiment: Neutral

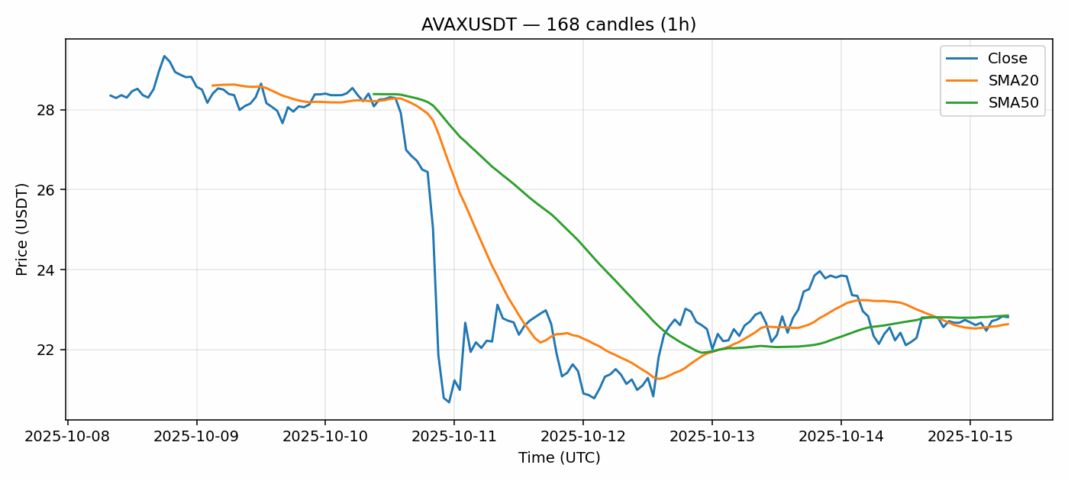

AVAX is showing resilience around the $22.80 level with a modest 2.3% gain over the past 24 hours. The current price sits between the 20-day SMA ($22.63) and 50-day SMA ($22.85), indicating consolidation near key moving averages. With RSI at 49.6, momentum appears neutral, neither overbought nor oversold. The $129 million trading volume suggests decent participation, though volatility remains elevated at 8.67%. Traders should watch for a decisive break above the 50-day SMA resistance for potential upside toward $24, while failure to hold $22.50 could trigger a test of $21.50 support. Given the tight range between moving averages, position sizing should remain conservative until clearer direction emerges. Consider accumulating on dips toward $22 with stops below $21.80 for swing trades.

Key Metrics

| Price | 22.8100 USDT |

| 24h Change | 2.33% |

| 24h Volume | 129703822.55 |

| RSI(14) | 49.61 |

| SMA20 / SMA50 | 22.63 / 22.85 |

| Daily Volatility | 8.67% |

Avalanche — 1h candles, 7D window (SMA20/SMA50, RSI).