Sentiment: Bullish

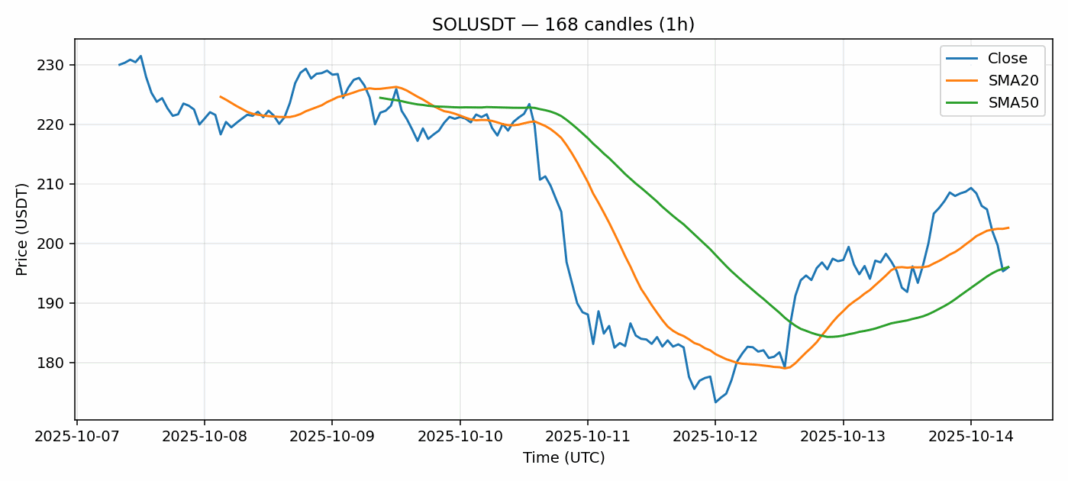

Solana (SOL) is currently trading at $195.97, showing modest 24-hour losses of -0.73% amid elevated volatility of 5.56%. The technical picture reveals compelling oversold conditions with RSI plunging to 27.53 – levels not seen since major market bottoms. SOL is trading below its 20-day SMA ($202.61) but has found support near its critical 50-day SMA ($196.03), suggesting this level represents a key battleground between bulls and bears. The substantial $1.49 billion 24-hour trading volume indicates strong institutional interest at these levels. For traders, current prices offer attractive entry opportunities for medium-term positions with tight stop losses below $190. The oversold RSI combined with SMA50 support creates a favorable risk-reward setup. Consider scaling into positions with targets at $210-215 resistance zones while managing risk carefully given the elevated volatility environment.

Key Metrics

| Price | 195.9700 USDT |

| 24h Change | -0.73% |

| 24h Volume | 1486282065.48 |

| RSI(14) | 27.53 |

| SMA20 / SMA50 | 202.61 / 196.03 |

| Daily Volatility | 5.56% |

Solana — 1h candles, 7D window (SMA20/SMA50, RSI).