XRP experienced a dramatic flash crash during recent market turbulence, plummeting over 50% within minutes before staging a significant recovery. The violent price movement triggered approximately $700 million in leveraged position liquidations across cryptocurrency exchanges, highlighting the vulnerability of digital asset markets during periods of stress.

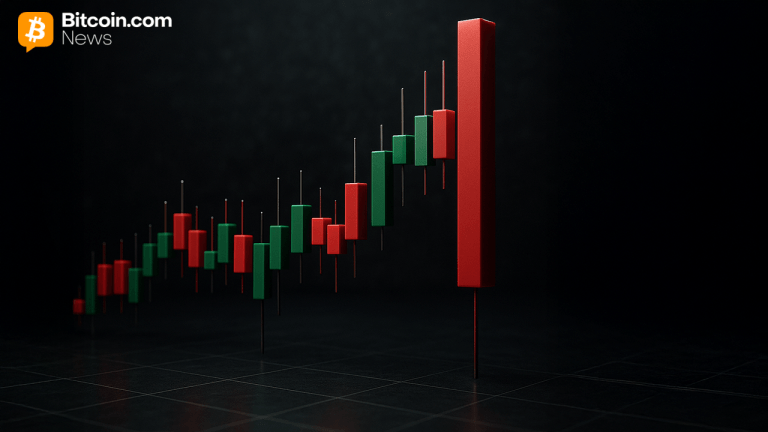

Market analysts examining the event point to excessive leverage combined with thin order book liquidity as primary contributors to the severity of the price drop. The rapid decline created an exceptionally long price wick on trading charts, indicating extreme volatility within a compressed timeframe.

While XRP quickly recovered most of its losses, the incident has sparked intense discussion among trading professionals and community members regarding potential coordinated trading activity. Some market participants suggest the cascade of liquidations may have been exacerbated by clustered stop-loss orders and margin calls in a low-liquidity environment.

The event underscores the inherent risks in cryptocurrency markets, particularly for highly leveraged positions during volatile conditions. Exchange data reveals that the flash crash affected multiple trading platforms simultaneously, though XRP’s price stabilization demonstrated the market’s ability to absorb such shocks and find equilibrium relatively quickly.