Sentiment: Bullish

XRP is showing signs of consolidation near the $2.39 level after a modest 1.55% decline over the past 24 hours. The current RSI reading of 34.78 indicates the asset is approaching oversold territory, potentially setting up for a near-term bounce. Trading volume remains robust at $625 million, suggesting continued institutional interest despite recent price pressure. The price currently trades slightly below the 20-day SMA of $2.40 but remains well above critical support levels. With volatility measured at 5.35%, XRP appears to be in a typical correction phase within a broader uptrend. Traders should watch for a break above the 20-day SMA as confirmation of renewed bullish momentum. Consider accumulating positions between $2.35-$2.40 with stops below $2.30. The oversold RSI condition combined with strong volume support suggests this dip may present a buying opportunity for swing traders targeting a retest of the $2.50 resistance zone.

Key Metrics

| Price | 2.3868 USDT |

| 24h Change | -1.55% |

| 24h Volume | 625196694.08 |

| RSI(14) | 34.78 |

| SMA20 / SMA50 | 2.40 / 2.51 |

| Daily Volatility | 5.35% |

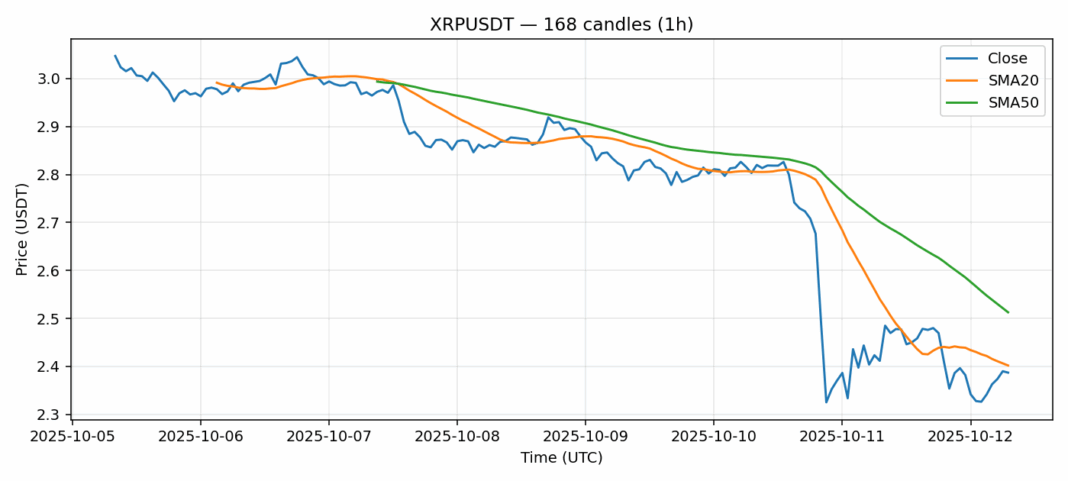

Ripple — 1h candles, 7D window (SMA20/SMA50, RSI).