Sentiment: Bullish

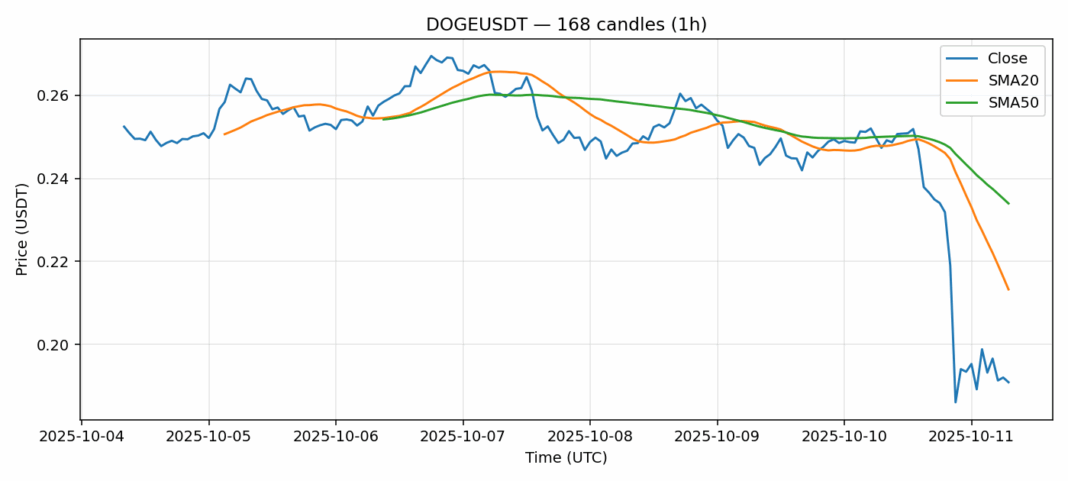

DOGE is experiencing severe selling pressure with a dramatic 23% decline over the past 24 hours, pushing the price to $0.191. The technical picture reveals deeply oversold conditions with RSI plunging to 25.88, well below the traditional 30 oversold threshold. More concerning is DOGE’s position relative to key moving averages – trading 10% below the 20-day SMA at $0.213 and 18% below the 50-day SMA at $0.234, indicating strong bearish momentum. Despite the elevated volatility of 8.27%, the substantial $1.58 billion trading volume suggests this isn’t a liquidity-driven flash crash but genuine capitulation. For traders, this presents a classic contrarian opportunity. While catching falling knives is risky, the extreme oversold RSI combined with strong volume often precedes short-term bounces. Consider scaling into long positions with tight stops below $0.185, targeting initial resistance at the 20-day SMA. Risk management is crucial – position sizes should reflect the heightened volatility environment.

Key Metrics

| Price | 0.1910 USDT |

| 24h Change | -23.23% |

| 24h Volume | 1582554161.39 |

| RSI(14) | 25.88 |

| SMA20 / SMA50 | 0.21 / 0.23 |

| Daily Volatility | 8.27% |

Dogecoin — 1h candles, 7D window (SMA20/SMA50, RSI).