Sentiment: Bearish

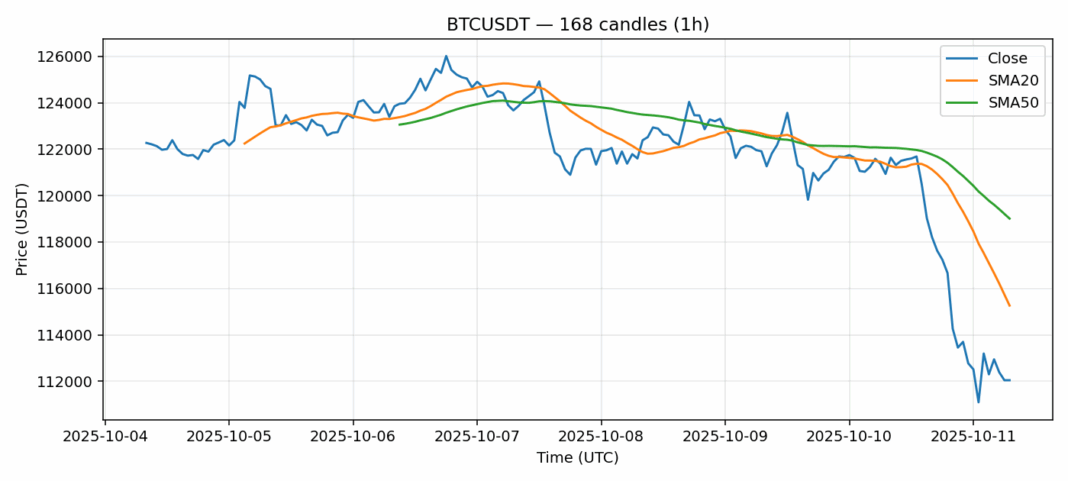

Bitcoin is experiencing significant selling pressure, down over 7.6% in the past 24 hours to trade around $112,045. The technical picture reveals concerning signals – the RSI reading of 25.9 indicates severely oversold conditions, typically suggesting potential for a short-term bounce. However, Bitcoin continues trading below both its 20-day SMA ($115,262) and 50-day SMA ($119,008), confirming the bearish momentum remains intact. The elevated volatility of 2.34% reflects heightened market uncertainty and position unwinding. Volume remains substantial at $8.6 billion, indicating institutional participation in the sell-off. For traders, this presents a classic dilemma between oversold bounce potential and sustained downward momentum. Conservative traders should wait for confirmation of support holding around $110,000 before considering long positions, while aggressive traders might scale into small positions here with tight stops below $110,000. The key resistance to watch remains the $115,000 level where the 20-day SMA currently resides.

Key Metrics

| Price | 112045.9700 USDT |

| 24h Change | -7.69% |

| 24h Volume | 8625994940.06 |

| RSI(14) | 25.89 |

| SMA20 / SMA50 | 115262.45 / 119008.61 |

| Daily Volatility | 2.34% |

Bitcoin — 1h candles, 7D window (SMA20/SMA50, RSI).