Sentiment: Bearish

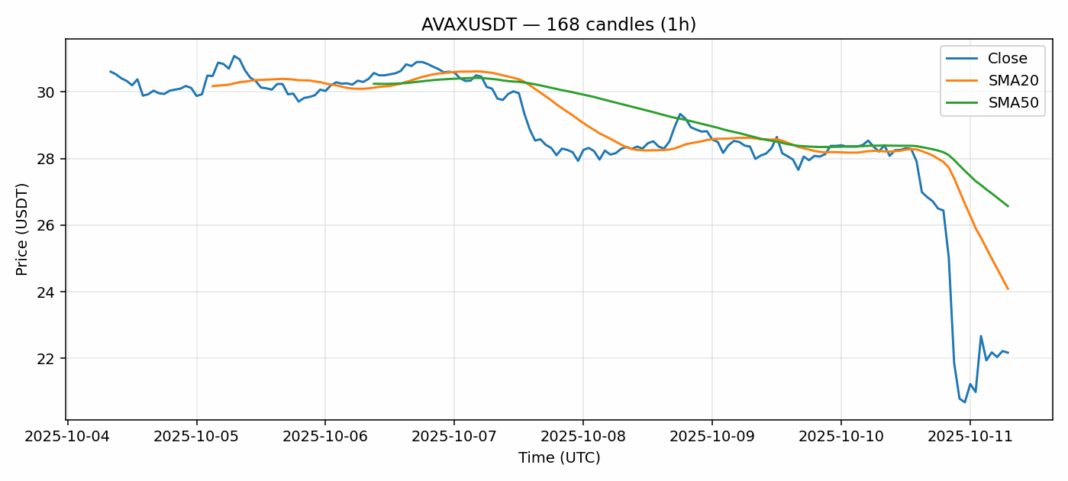

AVAX is showing significant technical distress with a brutal 21.77% decline over the past 24 hours, pushing the price to $22.17 against considerable selling pressure. The RSI reading of 26.9 indicates severely oversold conditions, typically preceding potential relief rallies. However, the price remains below both the 20-day SMA ($24.09) and 50-day SMA ($26.57), confirming the bearish momentum structure. Trading volume exceeding $434 million suggests capitulation-style selling, while elevated volatility at 7.49% warns of continued turbulence. For traders, this presents a high-risk environment – aggressive traders might consider scaling into long positions given extreme oversold readings, but should implement tight stop-losses below recent lows. Conservative traders should wait for confirmation of base formation and RSI recovery above 30 before considering entry. The current levels could attract institutional accumulation, but market structure remains fragile.

Key Metrics

| Price | 22.1700 USDT |

| 24h Change | -21.77% |

| 24h Volume | 434843761.05 |

| RSI(14) | 26.90 |

| SMA20 / SMA50 | 24.09 / 26.57 |

| Daily Volatility | 7.49% |

Avalanche — 1h candles, 7D window (SMA20/SMA50, RSI).