Sentiment: Neutral

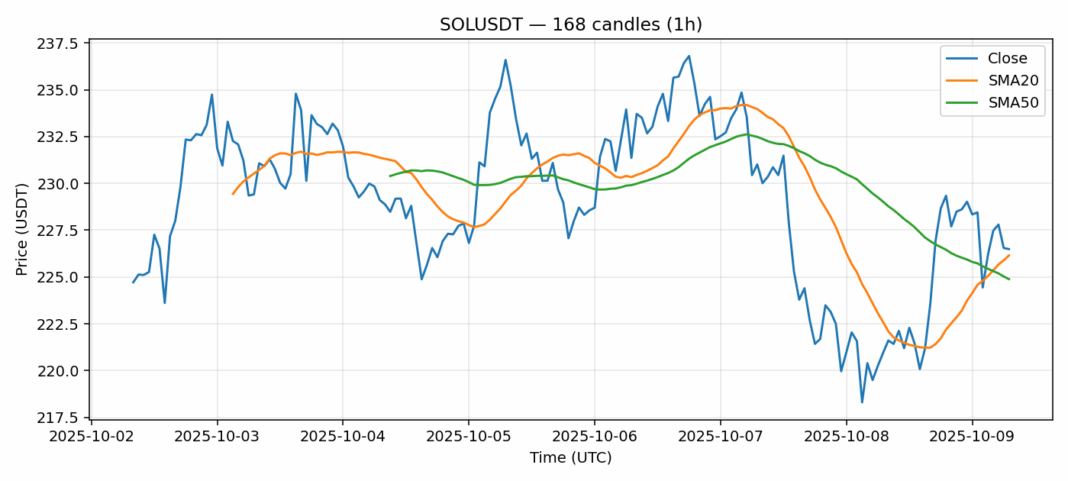

SOL is showing resilience at the $226 level, trading just above its 20-day SMA of $226.15 and 50-day SMA of $224.89, indicating potential support consolidation. The 2.88% 24-hour gain on substantial $682 million volume suggests accumulation despite the neutral RSI reading of 48.55. Current volatility of 3.1% presents both opportunity and risk – traders should watch for a decisive break above $230 for bullish continuation toward $240 resistance. However, failure to hold the SMA support cluster could trigger a retest of $220. The volume-profile suggests institutional interest remains healthy, though the neutral RSI indicates momentum needs catalyst for directional conviction. Position sizing should remain conservative until either support holds or resistance breaks. Consider scaling into longs above $228 with stops below $222 for risk management.

Key Metrics

| Price | 226.4600 USDT |

| 24h Change | 2.88% |

| 24h Volume | 681972607.14 |

| RSI(14) | 48.55 |

| SMA20 / SMA50 | 226.15 / 224.89 |

| Daily Volatility | 3.10% |

Solana — 1h candles, 7D window (SMA20/SMA50, RSI).