Sentiment: Bullish

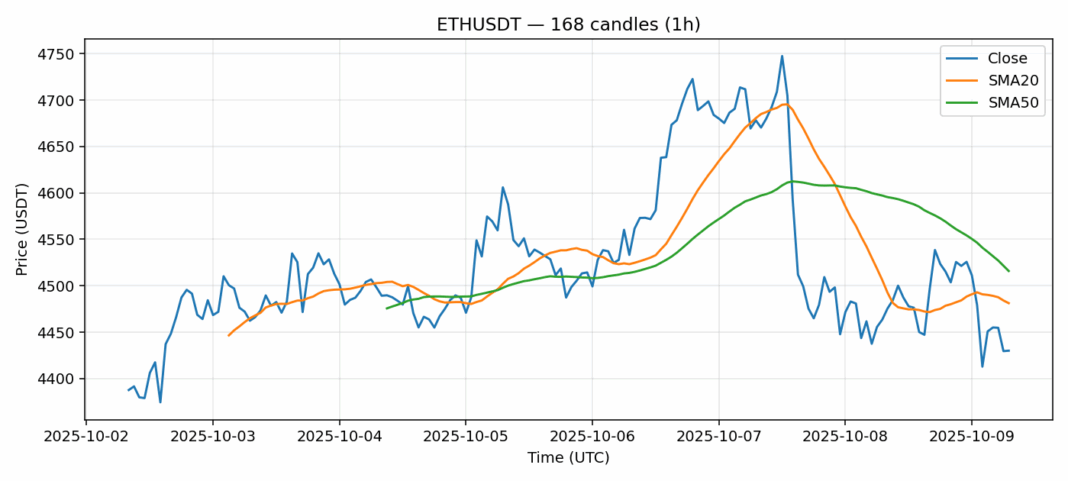

Ethereum is showing signs of potential reversal as it trades at $4,429, down just 0.53% over the past 24 hours despite significant selling pressure. The RSI reading of 28 indicates extreme oversold conditions, typically preceding a bullish reversal when combined with current price action. ETH is trading below both its 20-day SMA ($4,481) and 50-day SMA ($4,516), suggesting short-term bearish momentum, but the proximity to these key moving averages creates a critical decision point for traders. The $4,400 level appears to be providing solid support, while volume remains robust at $1.87 billion, indicating institutional interest at these levels. Traders should watch for a break above $4,500 with conviction for confirmation of upward momentum. Consider scaling into long positions with tight stops below $4,350, targeting initial resistance at $4,600. The current volatility of 2.57% presents attractive risk-reward opportunities for swing traders.

Key Metrics

| Price | 4429.4300 USDT |

| 24h Change | -0.53% |

| 24h Volume | 1872498890.38 |

| RSI(14) | 28.01 |

| SMA20 / SMA50 | 4481.22 / 4515.86 |

| Daily Volatility | 2.57% |

Ethereum — 1h candles, 7D window (SMA20/SMA50, RSI).