Sentiment: Bearish

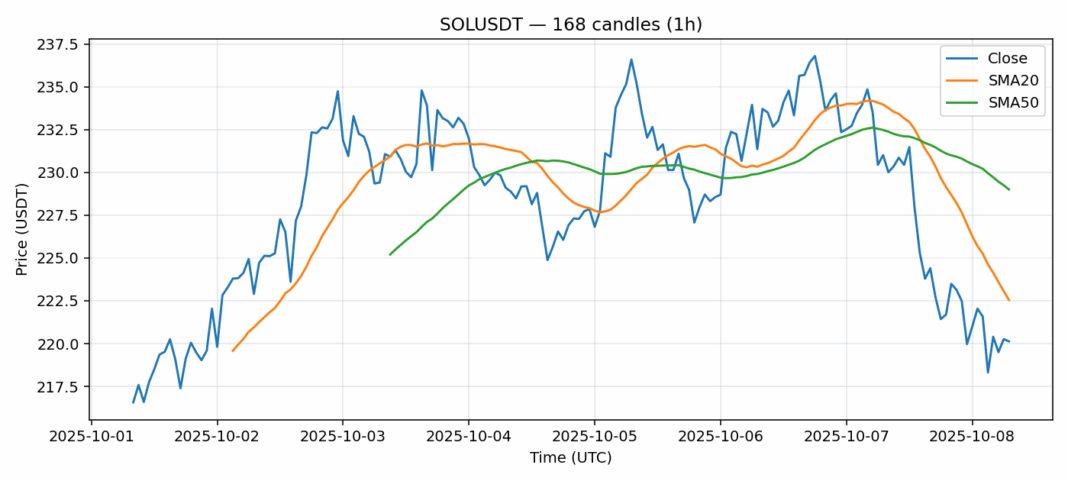

SOL faces a critical technical juncture after sliding 4.54% to $220.13, now trading below both its 20-day ($222.55) and 50-day ($229.01) SMAs. This signals near-term bearish momentum, though the RSI reading of 42 suggests we’re approaching oversold territory without being severely extended. The $220 level represents a crucial psychological support zone – a decisive break below could trigger further selling toward the $200-210 region. However, the substantial $1.01B 24-hour trading volume indicates strong institutional interest at these levels, potentially providing a foundation for consolidation. Traders should watch for a reclaim of the 20-day SMA as a potential bullish signal, while considering dollar-cost averaging into weakness for longer-term positions. Short-term traders might find scalping opportunities in the current 3% volatility band, but risk management remains paramount given the technical breakdown.

Key Metrics

| Price | 220.1300 USDT |

| 24h Change | -4.54% |

| 24h Volume | 1011826965.97 |

| RSI(14) | 42.23 |

| SMA20 / SMA50 | 222.55 / 229.01 |

| Daily Volatility | 3.06% |

Solana — 1h candles, 7D window (SMA20/SMA50, RSI).