Sentiment: Neutral

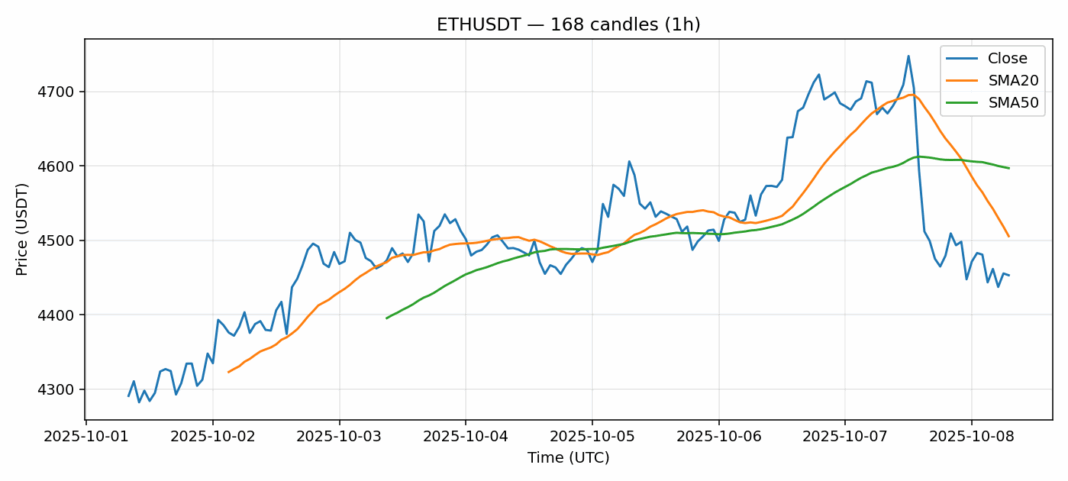

Ethereum faces a critical technical juncture as ETH/USDT trades at $4,453, down 4.6% over 24 hours amid elevated volatility. The current price sits below both the 20-day SMA ($4,506) and 50-day SMA ($4,597), suggesting near-term bearish momentum. However, the RSI reading of 45.8 indicates neither overbought nor oversold conditions, leaving room for directional movement. Trading volume remains robust at over $3 billion, signaling sustained institutional interest despite the pullback. For traders, watch for a decisive break above the 20-day SMA as a potential bullish signal, while failure to hold $4,400 could trigger further downside toward $4,200 support. Consider scaling into positions cautiously, using volatility to your advantage with tight stop-losses. The consolidation around these levels suggests accumulation may be occurring before the next significant move.

Key Metrics

| Price | 4453.1500 USDT |

| 24h Change | -4.62% |

| 24h Volume | 3004062674.73 |

| RSI(14) | 45.79 |

| SMA20 / SMA50 | 4505.57 / 4596.93 |

| Daily Volatility | 2.54% |

Ethereum — 1h candles, 7D window (SMA20/SMA50, RSI).