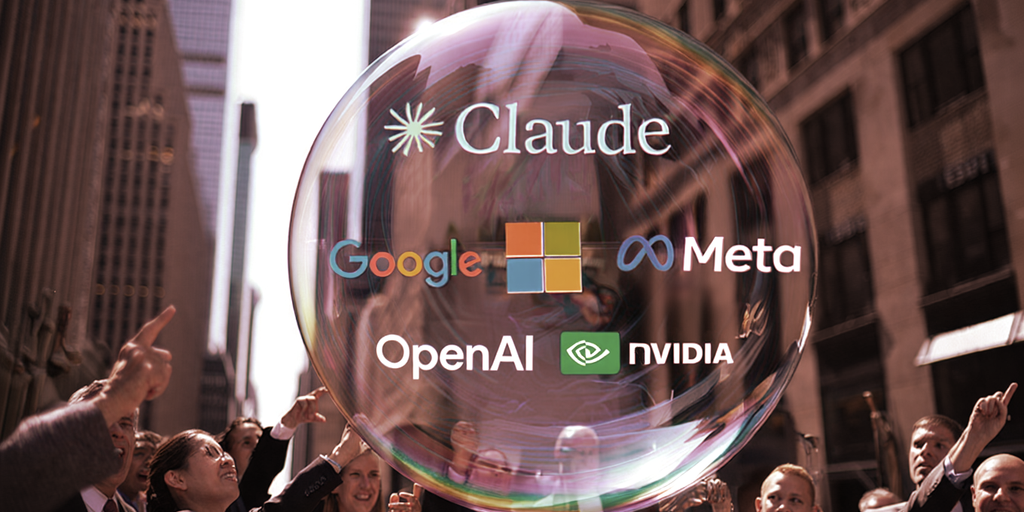

Recent economic analyses reveal that artificial intelligence investments now account for an overwhelming 92% of United States economic expansion, according to research from Harvard University economists. This unprecedented concentration in a single technological sector has raised significant concerns among financial experts and central banking authorities worldwide.

The Bank of England has issued particularly stark warnings about this development, suggesting that current market conditions resemble those preceding major economic corrections. Central bank officials have indicated that financial markets may be approaching a critical tipping point, where even a minor disruption could trigger substantial economic repercussions.

This extraordinary dependence on AI-driven growth represents a historic shift in economic fundamentals. While technological innovation has traditionally contributed to economic advancement, the current scale of reliance on a single technological domain is without modern precedent. Financial regulators and economic policymakers are closely monitoring the situation, concerned that such concentrated growth patterns could indicate underlying market vulnerabilities.

The situation presents a complex challenge for economic stewards, who must balance fostering innovation while maintaining financial stability. As investment continues to pour into artificial intelligence technologies, the global economic community watches carefully for signs of market adjustment that could affect broader financial systems.