Sentiment: Bearish

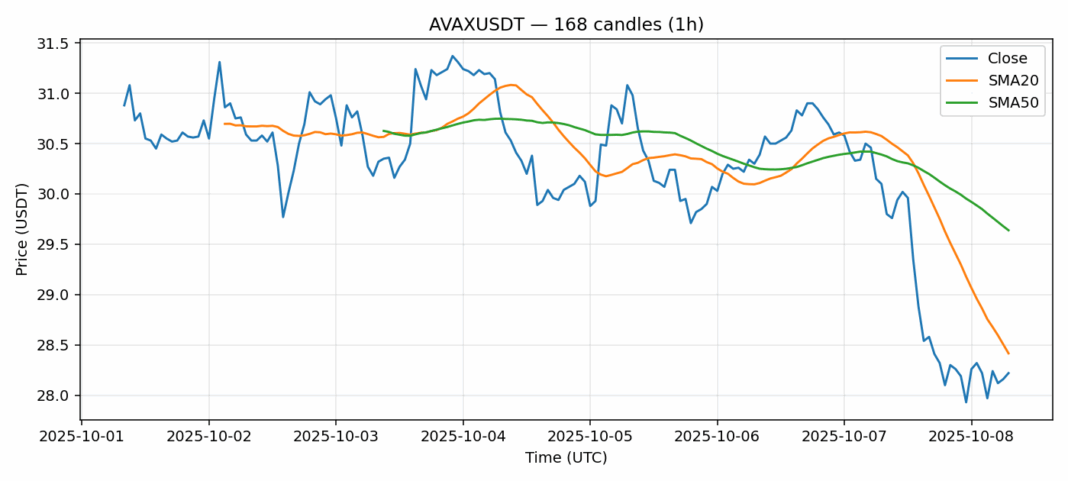

AVAX is showing concerning technical weakness as it trades at $28.22, down 6.5% over the past 24 hours. The token has broken below both its 20-day SMA ($28.42) and 50-day SMA ($29.64), indicating deteriorating medium-term momentum. While the RSI reading of 45.5 suggests AVAX is approaching oversold territory, it hasn’t yet reached levels that typically signal a strong reversal. Trading volume remains substantial at $143 million, suggesting active participation in this downturn. The current volatility of 3.1% indicates moderate price swings, which could present both risks and opportunities for traders. Given the breakdown below key moving averages, traders should consider waiting for a confirmed reversal pattern before entering long positions. A break below $27.50 could trigger further selling toward $25 support, while reclaiming the $29 level would be the first sign of potential recovery. Risk management remains crucial in this uncertain environment.

Key Metrics

| Price | 28.2200 USDT |

| 24h Change | -6.53% |

| 24h Volume | 143461468.20 |

| RSI(14) | 45.50 |

| SMA20 / SMA50 | 28.42 / 29.64 |

| Daily Volatility | 3.12% |

Avalanche — 1h candles, 7D window (SMA20/SMA50, RSI).