Sentiment: Bullish

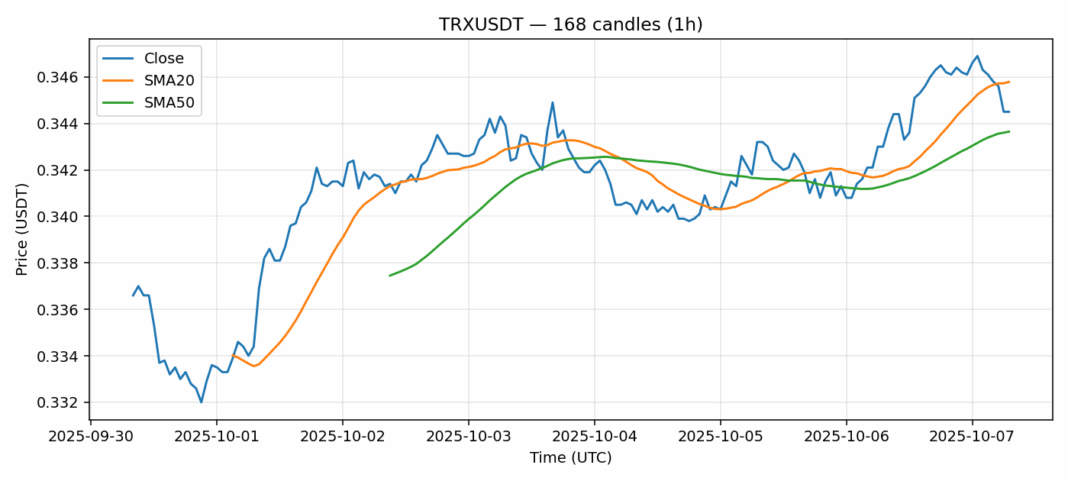

TRX is showing intriguing technical signals after a 0.44% gain in the past 24 hours. The current price of $0.3445 is trading just above the critical 50-day SMA at $0.3436, suggesting underlying strength despite the minimal movement. Most notably, the RSI reading of 29.55 indicates severely oversold conditions, typically preceding potential bullish reversals. Trading volume remains robust at over $86 million, providing adequate liquidity for position entries. The elevated volatility reading of 0.88 suggests traders should expect continued price swings. For active traders, current levels present a compelling risk-reward setup for long positions with tight stops below the 50-day SMA. The oversold RSI combined with price holding above key moving averages suggests accumulation may be occurring. However, given the high volatility, position sizing should remain conservative until we see a confirmed break above the 20-day SMA resistance at $0.3458.

Key Metrics

| Price | 0.3445 USDT |

| 24h Change | 0.44% |

| 24h Volume | 86236737.37 |

| RSI(14) | 29.55 |

| SMA20 / SMA50 | 0.35 / 0.34 |

| Daily Volatility | 0.88% |

TRON — 1h candles, 7D window (SMA20/SMA50, RSI).