Sentiment: Bullish

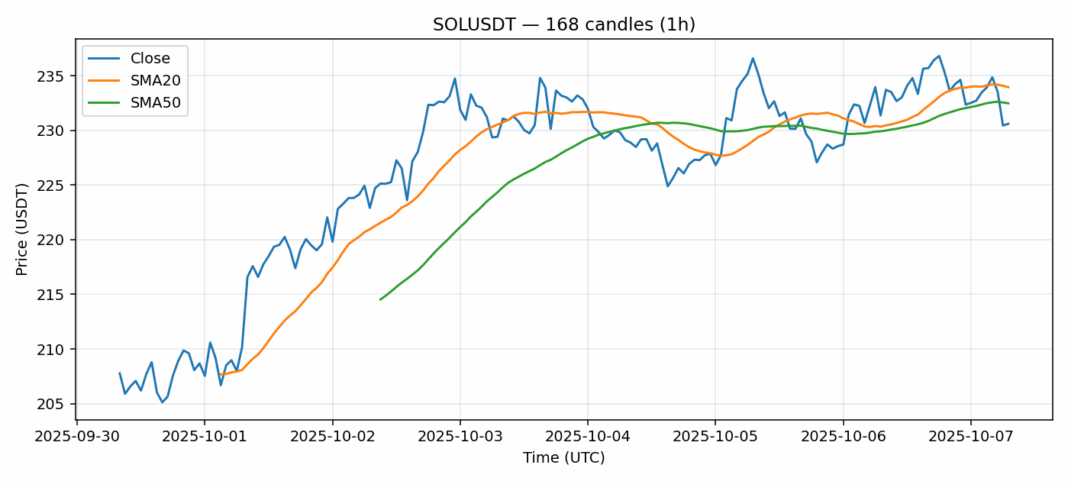

Solana (SOL) is showing intriguing technical signals as it trades at $230.6, down 1.3% over the past 24 hours. The most compelling development is the RSI reading of 29.12, indicating SOL has entered oversold territory – a level that historically precedes potential rebounds. Currently trading slightly below both its 20-day SMA ($233.95) and 50-day SMA ($232.47), the asset appears to be testing crucial support levels. The substantial $693 million daily trading volume suggests strong institutional interest despite recent price pressure. With volatility at 3.27%, traders should watch for consolidation around current levels before the next directional move. For position traders, accumulating near $225-230 support with tight stops below $220 could offer favorable risk-reward. Day traders should monitor for RSI divergence signals and volume spikes that typically precede trend reversals from oversold conditions. The current setup suggests limited downside from here with potential for a technical bounce toward $240-245 resistance zones.

Key Metrics

| Price | 230.6000 USDT |

| 24h Change | -1.30% |

| 24h Volume | 693846200.80 |

| RSI(14) | 29.12 |

| SMA20 / SMA50 | 233.95 / 232.47 |

| Daily Volatility | 3.27% |

Solana — 1h candles, 7D window (SMA20/SMA50, RSI).