Sentiment: Bullish

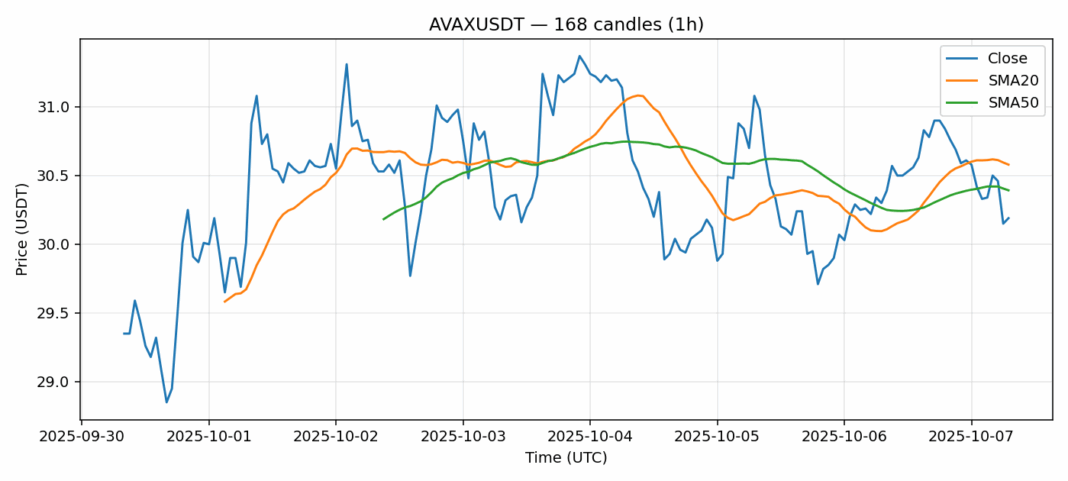

AVAX is showing intriguing technical signals at the $30.18 level despite the modest 24-hour decline of 1.86%. The most compelling development is the deeply oversold RSI reading of 19.66, which represents one of the most extreme oversold conditions we’ve seen in AVAX this year. Historically, RSI levels below 20 have preceded significant bounces in AVAX price action. The current price sits just below both the 20-day SMA ($30.58) and 50-day SMA ($30.39), creating a potential inflection point. Trading volume remains robust at over $90 million, suggesting institutional interest at these levels. For traders, this presents a potential accumulation opportunity with tight stop losses below $29.50. The elevated volatility of 3.32% indicates potential for sharp moves, making position sizing crucial. Consider scaling into long positions with targets at $32.50 and $34.00, while monitoring for any breakdown below the $29 support level that would invalidate the bullish setup.

Key Metrics

| Price | 30.1800 USDT |

| 24h Change | -0.56% |

| 24h Volume | 90263748.10 |

| RSI(14) | 19.66 |

| SMA20 / SMA50 | 30.58 / 30.39 |

| Daily Volatility | 3.32% |

Avalanche — 1h candles, 7D window (SMA20/SMA50, RSI).