Publicly traded Bitcoin mining corporations are experiencing remarkable stock performance as the world’s premier digital currency achieves unprecedented valuation milestones. Industry leaders including Marathon Digital Holdings and Riot Platforms have witnessed double-digit percentage gains, significantly outpacing broader market indices.

The mining sector’s robust performance directly correlates with Bitcoin’s accelerating valuation, which recently surpassed its previous all-time high established in 2021. This symbiotic relationship demonstrates how mining operations leverage substantial fixed infrastructure investments to capitalize on favorable market conditions.

Market analysts attribute this exceptional performance to multiple converging factors. Institutional adoption continues to expand through recently approved investment vehicles, while global macroeconomic uncertainties persist, driving increased digital asset allocation. The upcoming Bitcoin halving event, expected to reduce new coin issuance by 50%, has further intensified investor interest in mining companies positioned to benefit from potential supply constraints.

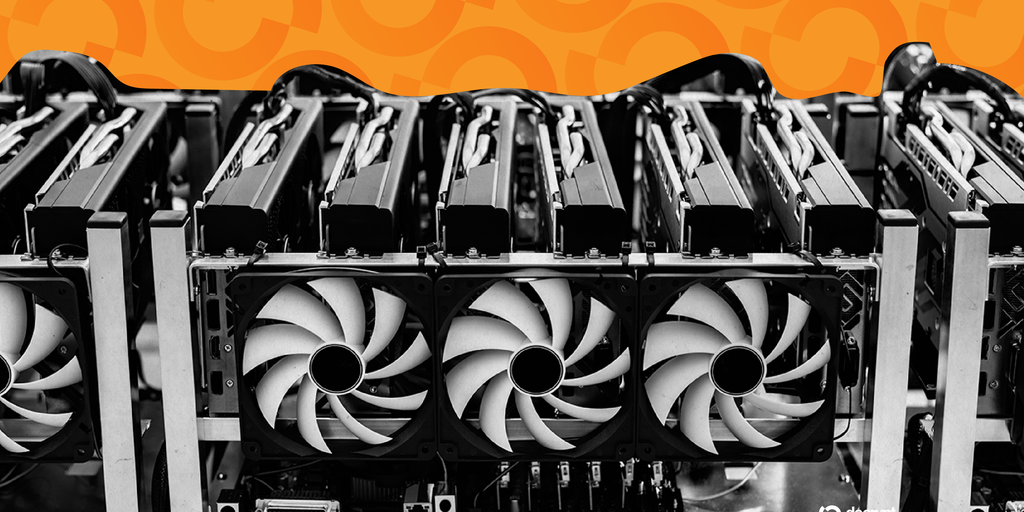

Industry observers note that mining operations with efficient energy contracts and modern hardware fleets are particularly well-positioned to maintain profitability even as network difficulty adjustments occur. The sector’s collective market capitalization has expanded dramatically, reflecting renewed investor confidence in Bitcoin’s long-term value proposition and the critical role miners play in network security and transaction validation.