Sentiment: Bullish

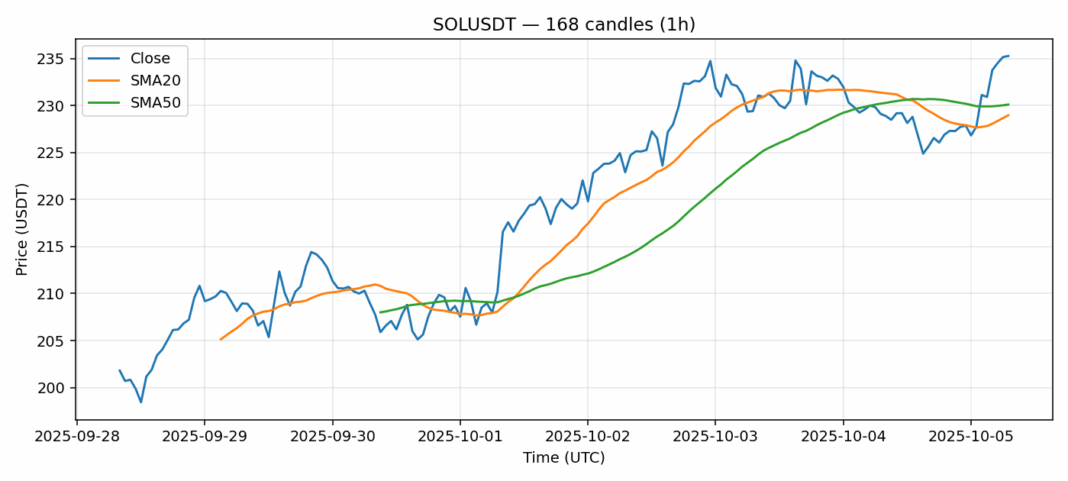

SOL is showing impressive momentum, trading at $235.27 with a 2.38% gain over the past 24 hours. The current price sits above both the 20-day SMA ($228.97) and 50-day SMA ($230.11), indicating strong bullish positioning. However, the extremely overbought RSI reading of 85.56 raises significant concerns about sustainability at these levels. While the substantial $557 million trading volume confirms strong institutional interest, such elevated RSI levels typically precede corrective moves. Traders should consider taking partial profits here and waiting for a pullback toward the $225-228 support zone before adding new positions. The 3.34% volatility suggests SOL remains in an active trading range, but risk management is crucial given the stretched technical indicators. Current momentum favors bulls, but caution is warranted for new entries at these elevated levels.

Key Metrics

| Price | 235.2700 USDT |

| 24h Change | 2.38% |

| 24h Volume | 557913504.18 |

| RSI(14) | 85.56 |

| SMA20 / SMA50 | 228.97 / 230.11 |

| Daily Volatility | 3.34% |

Solana — 1h candles, 7D window (SMA20/SMA50, RSI).