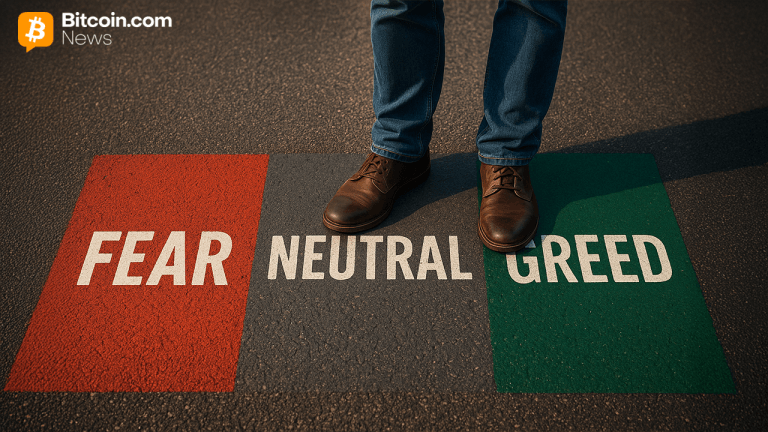

The cryptocurrency sector is witnessing a notable transformation in investor sentiment as digital asset valuations maintain robust levels above $4 trillion. Bitcoin’s recent surge past its previous all-time high has triggered significant shifts in market psychology indicators, with established fear and greed indexes now reflecting a complex interplay between cautious neutrality and emerging bullish enthusiasm. This evolving emotional landscape typically precedes increased investor participation, often translating into accelerated purchasing activity and subsequent price appreciation across digital assets.

Market analysts observe that these sentiment fluctuations frequently create self-reinforcing cycles where improving market psychology encourages additional capital deployment, potentially driving further valuation gains. The current environment demonstrates how cryptocurrency markets remain highly responsive to psychological factors, with sentiment indicators serving as crucial barometers for potential price trajectories.

As institutional and retail investors alike monitor these developments, the delicate balance between measured optimism and speculative fervor continues to shape trading strategies and portfolio allocations. The sustained market capitalization milestone combined with bitcoin’s record-breaking performance underscores the cryptocurrency ecosystem’s ongoing maturation while highlighting the persistent influence of collective market psychology on price discovery mechanisms.