Sentiment: Neutral

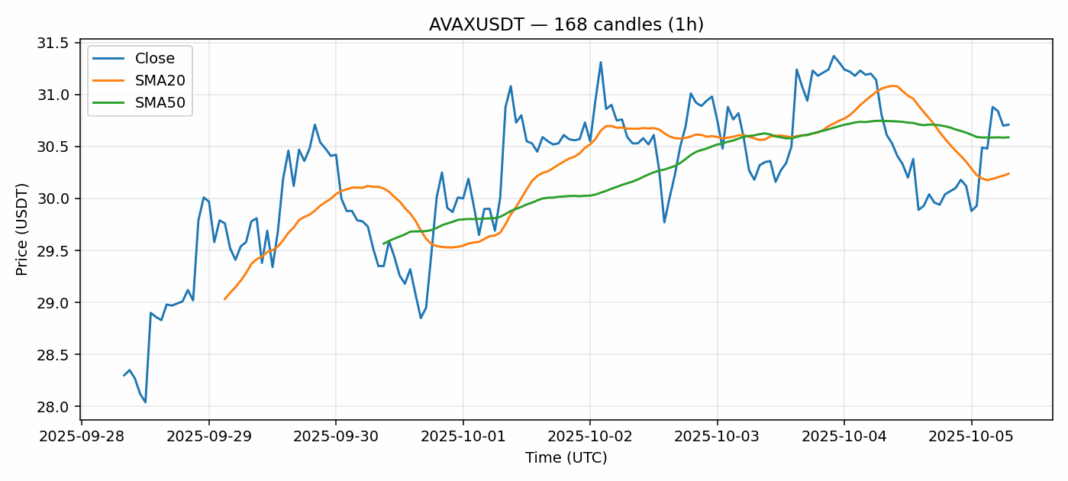

AVAX is showing mixed signals as it trades at $30.71, down 1.38% over the past 24 hours. The current price sits just above the 20-day SMA of $30.24 but below the 50-day SMA of $30.59, indicating potential resistance at these levels. Volume remains healthy at $87 million, suggesting continued institutional interest. However, the RSI reading of 71.19 places AVAX in overbought territory, signaling potential for a short-term pullback. The 3.87% volatility indicates moderate price swings are likely. Traders should watch for a decisive break above $31.50 for bullish continuation, while a drop below $29.80 could trigger further selling. Consider taking partial profits at current levels and setting buy orders near $29.50 for better risk-reward entries. Position sizing should remain conservative given the elevated RSI and current market uncertainty.

Key Metrics

| Price | 30.7100 USDT |

| 24h Change | -1.38% |

| 24h Volume | 86993947.37 |

| RSI(14) | 71.19 |

| SMA20 / SMA50 | 30.24 / 30.59 |

| Daily Volatility | 3.87% |

Avalanche — 1h candles, 7D window (SMA20/SMA50, RSI).