Sentiment: Bullish

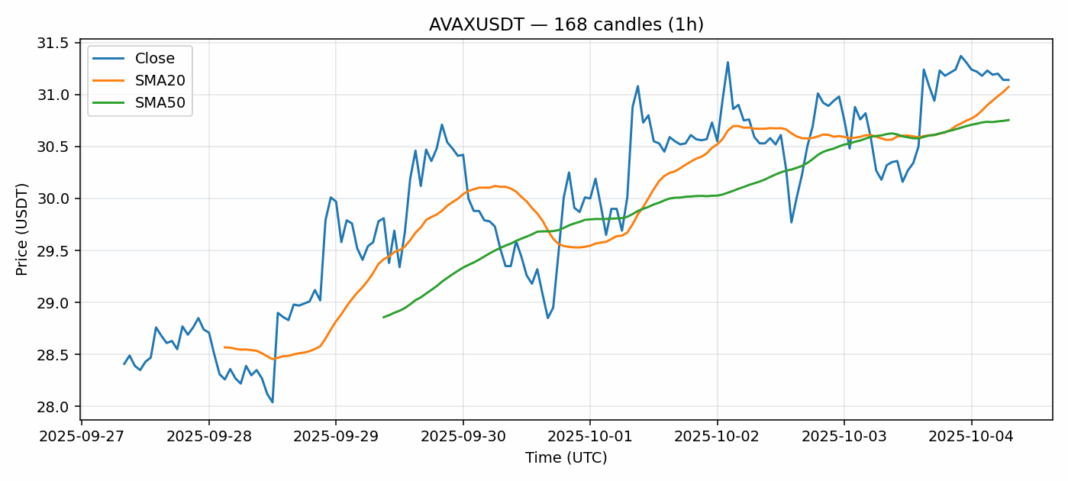

AVAX is showing constructive technical positioning as it trades at $31.14, holding firmly above both its 20-day ($31.07) and 50-day ($30.75) moving averages. The 3.04% gain over the past 24 hours, coupled with strong volume of $134 million, suggests institutional accumulation is supporting this move. The RSI reading of 61 indicates healthy momentum without entering overbought territory, while the 3.73% volatility metric shows controlled price action. Traders should watch for a sustained break above the $31.50 level, which could trigger a move toward $33 resistance. On the downside, the $30.75 SMA50 provides solid support. Current market structure favors buying dips toward the $30.80-$31.00 zone with stops below $30.50. The volume profile suggests genuine buying interest rather than speculative froth, making AVAX one of the stronger altcoin setups in the current environment.

Key Metrics

| Price | 31.1400 USDT |

| 24h Change | 3.04% |

| 24h Volume | 134425515.74 |

| RSI(14) | 61.36 |

| SMA20 / SMA50 | 31.07 / 30.75 |

| Daily Volatility | 3.73% |

Avalanche — 1h candles, 7D window (SMA20/SMA50, RSI).