Sentiment: Bullish

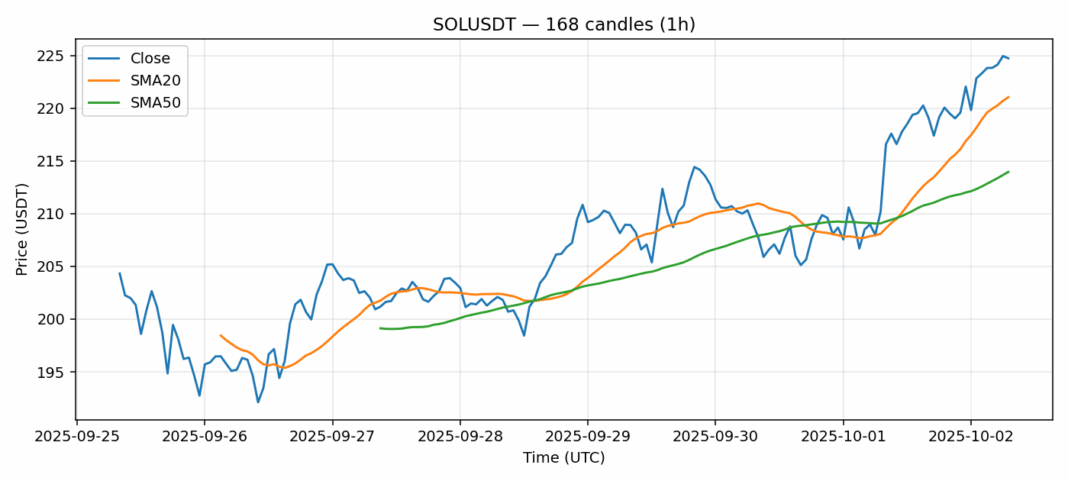

SOL is showing strong momentum with a 7.96% surge over the past 24 hours, pushing the price to $224.72. This places it firmly above both the 20-day SMA ($221.04) and 50-day SMA ($213.95), indicating a solid uptrend. However, caution is warranted as the RSI reading of 75.68 signals overbought conditions, suggesting potential for a near-term pullback. The high volatility of 3.59% combined with substantial $965M daily volume reflects active trader participation. For current positions, consider taking partial profits near resistance levels around $230. New entries should wait for a healthy retracement toward the $215-218 support zone. Traders might implement tighter stop-losses below $220 to protect gains while maintaining core positions for the broader bullish structure.

Key Metrics

| Price | 224.7200 USDT |

| 24h Change | 7.96% |

| 24h Volume | 965092530.92 |

| RSI(14) | 75.68 |

| SMA20 / SMA50 | 221.04 / 213.95 |

| Daily Volatility | 3.59% |

Solana — 1h candles, 7D window (SMA20/SMA50, RSI).