Sentiment: Neutral

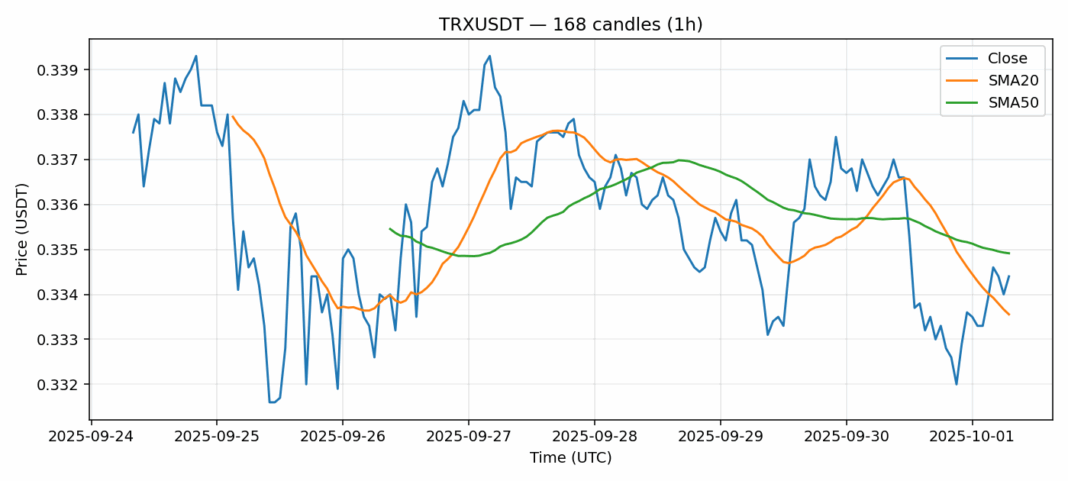

TRX is showing mixed signals as it trades at $0.3344, down 0.6% over the past 24 hours. The token finds itself in a critical technical position, hovering just above the 20-day SMA at $0.3335 but slightly below the 50-day SMA at $0.3349. This consolidation pattern suggests the market is searching for direction after recent volatility. The RSI reading of 62 indicates moderate bullish momentum but remains comfortably below overbought territory. Trading volume of $58.9 million appears healthy, supporting current price levels. For traders, watch the $0.333-0.335 range closely – a sustained break above the 50-day SMA could signal upward momentum toward $0.34, while failure to hold the 20-day SMA support might trigger a retest of $0.33. Given the current technical setup, consider scaling into positions on dips toward support with tight stops below $0.33. The moderate volatility of 1.18% suggests manageable risk for position traders.

Key Metrics

| Price | 0.3344 USDT |

| 24h Change | -0.59% |

| 24h Volume | 58951161.64 |

| RSI(14) | 62.07 |

| SMA20 / SMA50 | 0.33 / 0.33 |

| Daily Volatility | 1.18% |

TRON — 1h candles, 7D window (SMA20/SMA50, RSI).