Sentiment: Neutral

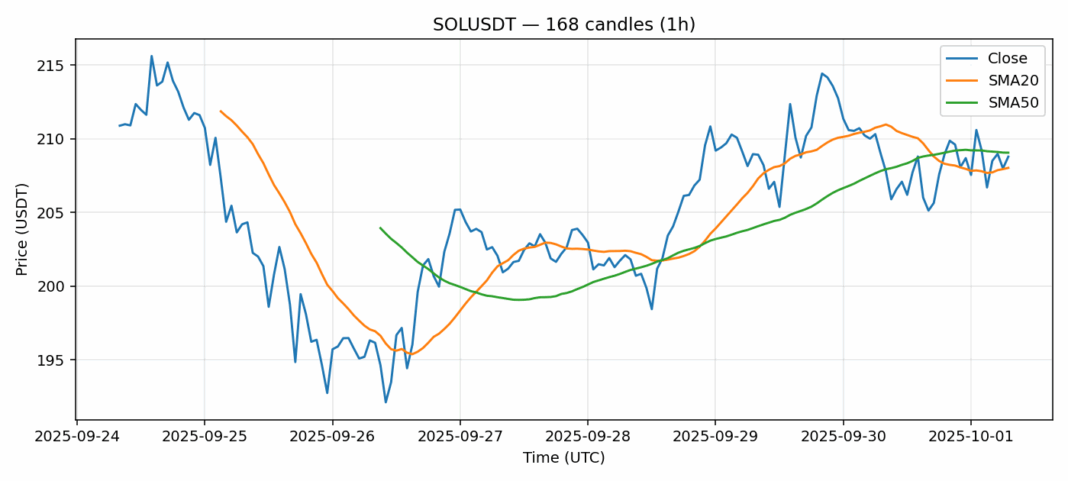

SOL is currently trading at $208.78, showing modest weakness with a 0.8% decline over the past 24 hours. The technical picture presents a mixed but cautiously optimistic outlook. SOL is trading just above its 20-day SMA of $208.02 but slightly below the 50-day SMA of $209.05, indicating consolidation near key moving averages. The RSI reading of 58.35 suggests the asset is neither overbought nor oversold, leaving room for potential upward movement. Trading volume remains robust at over $716 million, providing healthy liquidity. The 3.5% volatility reading indicates typical crypto market conditions without excessive price swings. For traders, current levels around $208 present a potential accumulation zone with support likely forming near the $205-207 range. Resistance appears around $212-215. Consider scaling into positions on dips toward support, with stop losses below $200 for risk management. The overall structure suggests SOL is building a base for its next directional move.

Key Metrics

| Price | 208.7800 USDT |

| 24h Change | -0.80% |

| 24h Volume | 716542126.05 |

| RSI(14) | 58.35 |

| SMA20 / SMA50 | 208.02 / 209.05 |

| Daily Volatility | 3.53% |

Solana — 1h candles, 7D window (SMA20/SMA50, RSI).