Sentiment: Neutral

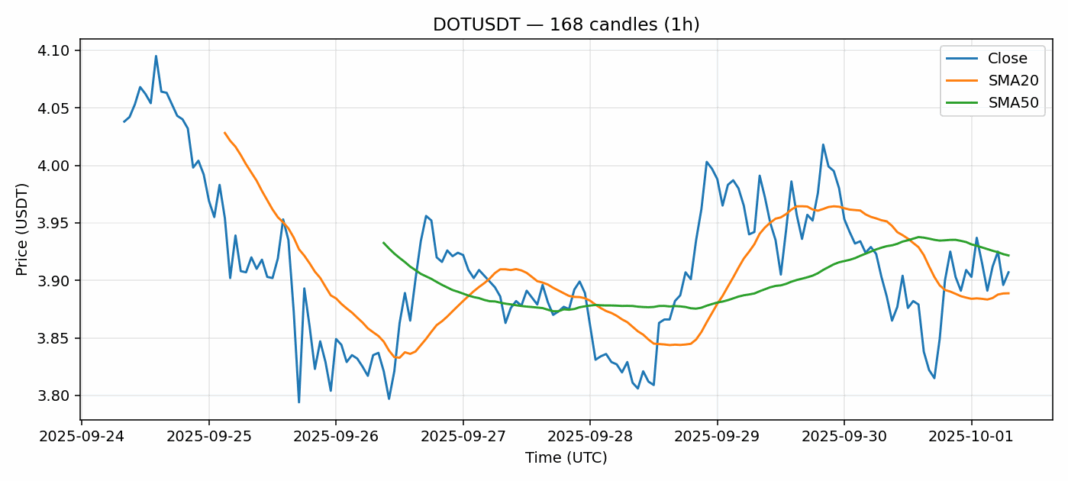

DOT is showing mixed signals as it trades at $3.907, down 10.5% over the past 24 hours despite healthy trading volume of $14.6 million. The current price sits just above the 20-day SMA at $3.889 but below the 50-day SMA at $3.922, indicating potential resistance overhead. With RSI at 64.29, DOT approaches overbought territory though not yet at extreme levels. The 2.94% volatility suggests moderate price swings are expected. For traders, the key level to watch is the $3.89 support – a sustained break below could trigger further selling toward $3.75. Conversely, reclaiming the $3.92 resistance with conviction could target $4.10. Position sizing should account for the elevated volatility, and stop-losses around $3.85 would be prudent given the recent downturn. The volume suggests institutional interest remains, but buyers need to step in soon to prevent further deterioration.

Key Metrics

| Price | 3.9070 USDT |

| 24h Change | -0.46% |

| 24h Volume | 14639310.29 |

| RSI(14) | 64.29 |

| SMA20 / SMA50 | 3.89 / 3.92 |

| Daily Volatility | 2.94% |

Polkadot — 1h candles, 7D window (SMA20/SMA50, RSI).