Sentiment: Neutral

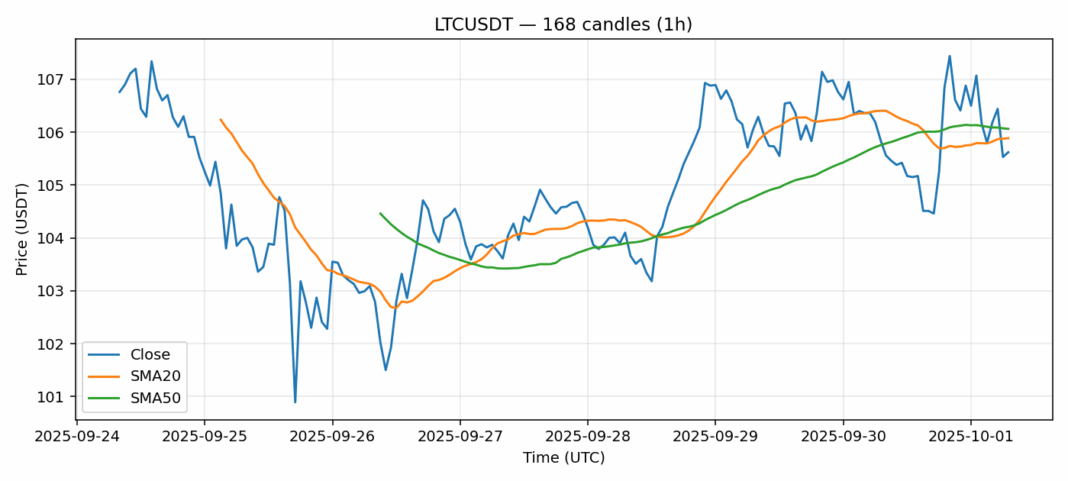

LTCUSDT is showing consolidation around the $105.62 level, trading slightly below both its 20-day SMA ($105.89) and 50-day SMA ($106.06), indicating near-term resistance. The 24-hour decline of 0.36% reflects modest selling pressure, though the RSI at 56.95 remains in neutral territory with room for movement in either direction. Trading volume of $27.7 million suggests adequate liquidity, while volatility of 2.34% indicates relatively stable price action compared to typical crypto standards. Traders should watch for a decisive break above the $106 resistance cluster formed by the moving averages – such a move could trigger momentum toward $108-110. Conversely, failure to hold $104 support could see a retest of $102 levels. Given the technical setup, consider scaling into positions on dips toward support with tight stops, as LTC appears to be building energy for its next directional move. The balanced technical picture suggests patience is warranted until clearer momentum emerges.

Key Metrics

| Price | 105.6200 USDT |

| 24h Change | -0.36% |

| 24h Volume | 27701763.94 |

| RSI(14) | 56.95 |

| SMA20 / SMA50 | 105.89 / 106.06 |

| Daily Volatility | 2.34% |

Litecoin — 1h candles, 7D window (SMA20/SMA50, RSI).