Sentiment: Neutral

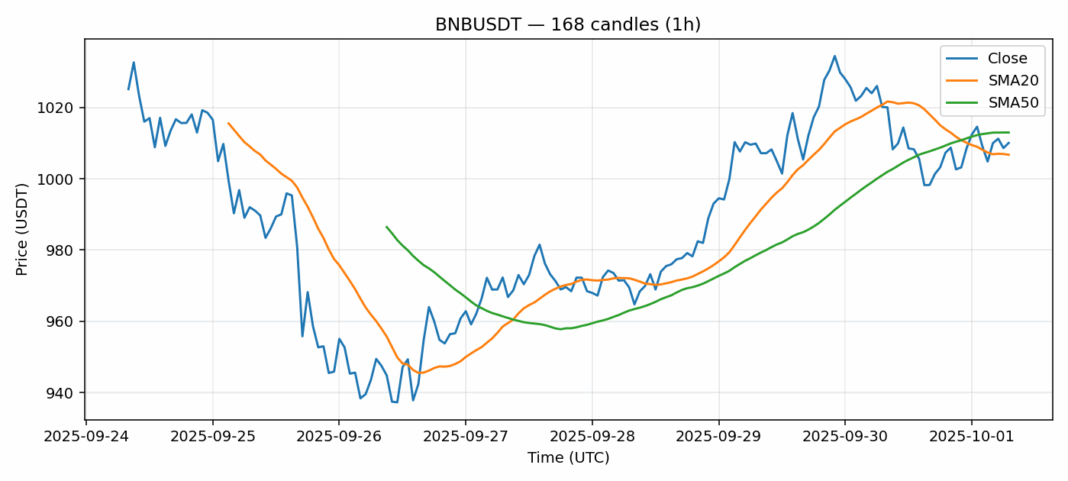

BNB is showing mixed signals at the $1,010 level, trading slightly below its 50-day SMA of $1,013 but holding above the 20-day SMA of $1,007. The -1.67% 24-hour decline suggests some profit-taking pressure, though the RSI at 59.5 indicates neither overbought nor oversold conditions. Trading volume remains healthy at $252 million, providing adequate liquidity for institutional moves. The 2.66% volatility reading suggests moderate price swings are likely in the near term. Traders should watch for a decisive break above $1,015 for bullish continuation, while a drop below $1,005 could signal further downside toward the $990 support zone. Given the current technical setup, consider scaling into positions with tight stops, as BNB appears to be consolidating before its next directional move. The proximity to key moving averages makes this a critical inflection point for medium-term trend determination.

Key Metrics

| Price | 1010.0400 USDT |

| 24h Change | -1.67% |

| 24h Volume | 252511327.33 |

| RSI(14) | 59.52 |

| SMA20 / SMA50 | 1006.72 / 1012.96 |

| Daily Volatility | 2.66% |

BNB — 1h candles, 7D window (SMA20/SMA50, RSI).