Sentiment: Bullish

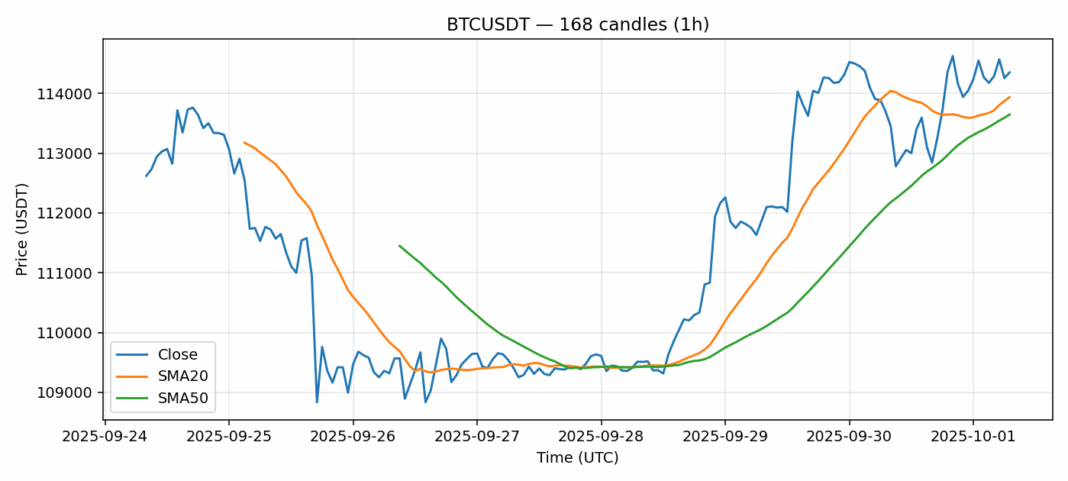

Bitcoin continues to show impressive resilience, trading at $114,352 with a modest 0.4% gain over the past 24 hours. The current price action finds BTC comfortably above both the 20-day SMA ($113,938) and 50-day SMA ($113,646), indicating underlying bullish momentum remains intact. The RSI reading of 64 suggests we’re approaching overbought territory but still has room before hitting extreme levels. Trading volume exceeding $1.65 billion demonstrates healthy participation, while volatility at 1.5% indicates relatively stable conditions for crypto standards. For traders, the key levels to watch are the $113,600-$113,900 support zone formed by the moving averages. A sustained break above $115,000 could trigger another leg higher, while failure to hold $113,600 might signal a short-term correction. Position sizing should remain conservative given the elevated RSI, with stop-losses ideally placed below the 50-day SMA.

Key Metrics

| Price | 114352.2100 USDT |

| 24h Change | 0.40% |

| 24h Volume | 1654596034.54 |

| RSI(14) | 64.36 |

| SMA20 / SMA50 | 113937.64 / 113645.79 |

| Daily Volatility | 1.51% |

Bitcoin — 1h candles, 7D window (SMA20/SMA50, RSI).