Sentiment: Neutral

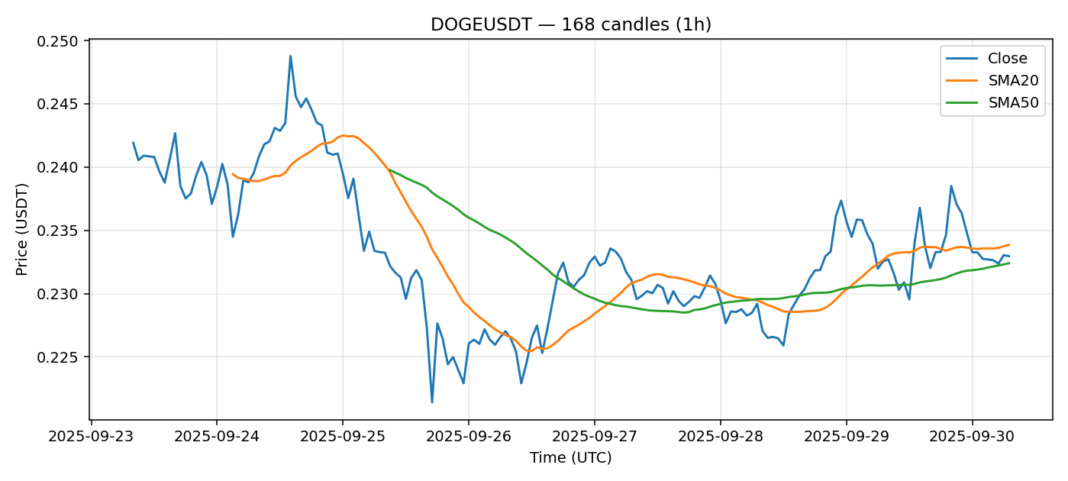

DOGE is showing mixed signals at current levels. The price is consolidating around $0.233, trading slightly below the 20-day SMA but holding above the 50-day SMA, indicating near-term resistance but medium-term support. The 0.44% 24-hour gain is modest, though accompanied by substantial $235M volume suggesting active participation. RSI at 48.7 sits in neutral territory, neither overbought nor oversold, giving room for movement in either direction. The 3.4% volatility reading suggests typical meme coin fluctuations. Given the technical setup, I’d watch for a decisive break above $0.235 (20-SMA) for potential momentum toward $0.245. Alternatively, failure to hold $0.230 could see a test of $0.225 support. Position sizing should remain conservative given DOGE’s inherent volatility. Consider scaling into positions rather than full allocation entries, with tight stops given the current indecision in price action.

Key Metrics

| Price | 0.2330 USDT |

| 24h Change | 0.44% |

| 24h Volume | 234727572.05 |

| RSI(14) | 48.72 |

| SMA20 / SMA50 | 0.23 / 0.23 |

| Daily Volatility | 3.41% |

Dogecoin — 1h candles, 7D window (SMA20/SMA50, RSI).