Sentiment: Bullish

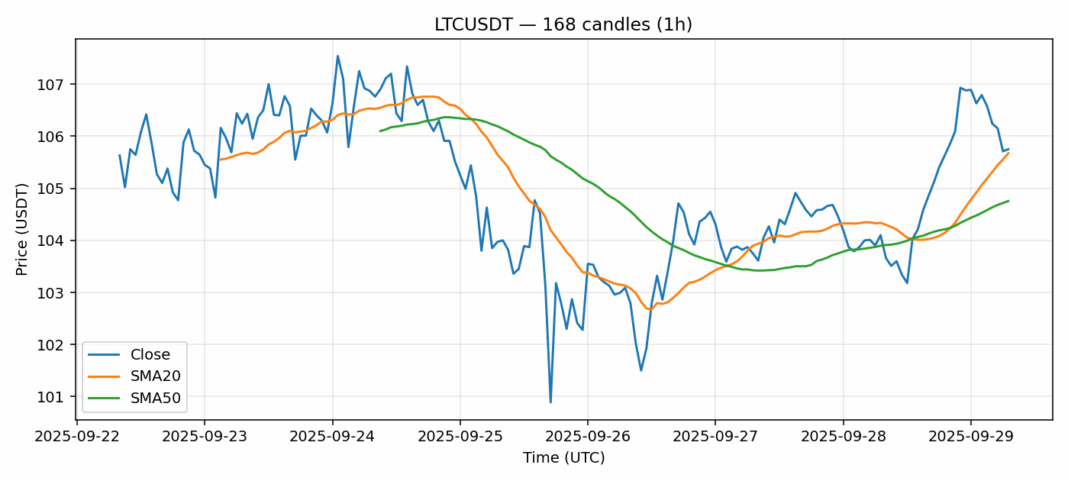

LTCUSDT is showing constructive technical positioning at $105.75, trading marginally above both its 20-day ($105.67) and 50-day ($104.76) SMAs. This indicates underlying support remains intact despite modest daily gains of 1.77%. The RSI reading of 59.36 suggests neutral-to-bullish momentum without entering overbought territory, providing room for potential upside. Volume activity appears healthy at $22M, supporting current price levels. With volatility measured at 2.42%, LTC is exhibiting relatively stable price action compared to typical crypto assets. Traders should watch for a sustained break above $106 as confirmation of bullish continuation, with initial resistance likely around $108. Support holds at the SMA confluence zone of $104.50-$105. Consider accumulating on dips toward $104 with stops below $103 for risk management. The setup favors cautious optimism for near-term appreciation.

Key Metrics

| Price | 105.7500 USDT |

| 24h Change | 1.77% |

| 24h Volume | 21999082.36 |

| RSI(14) | 59.36 |

| SMA20 / SMA50 | 105.67 / 104.76 |

| Daily Volatility | 2.42% |

Litecoin — 1h candles, 7D window (SMA20/SMA50, RSI).