Sentiment: Neutral

“`json

{

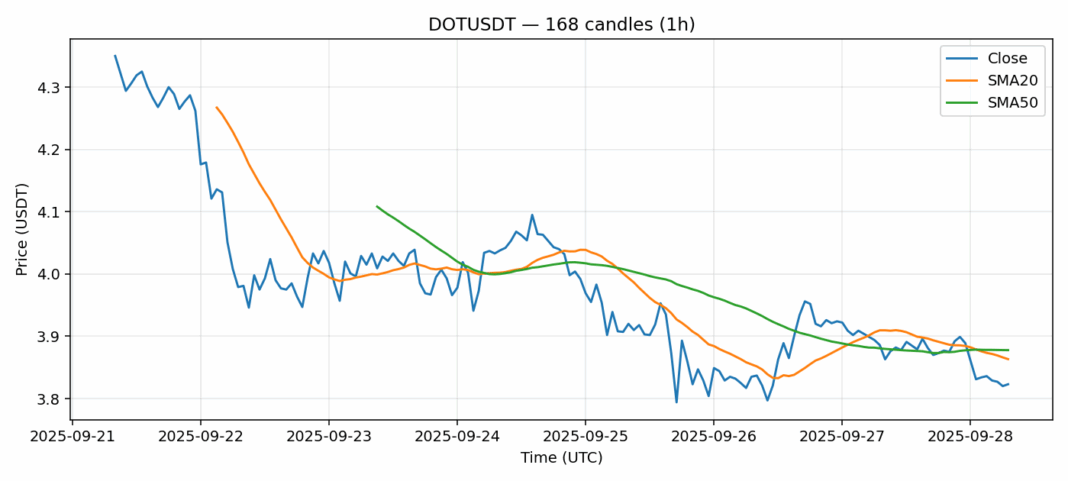

“analysis”: “DOT is showing concerning technical signals with the price currently at $3.823, down nearly 2% over the past 24 hours. The RSI reading of 31 indicates the asset is approaching oversold territory, which typically suggests potential for a short-term bounce. However, DOT remains below both its 20-day SMA ($3.863) and 50-day SMA ($3.878), confirming the bearish momentum remains intact. Trading volume of $10.2 million appears moderate but insufficient to drive a meaningful reversal. The 3.25% volatility suggests relatively stable price action despite the downward pressure. For traders, I’d recommend waiting for a confirmed break above the 20-day SMA with strong volume before considering long positions. Short-term traders might find scalping opportunities near the $3.75-$3.80 support zone, but risk management remains crucial given the overall bearish structure. Consider setting tight stops if attempting counter-trend trades.”,

“tags”: [“dot price analysis”, “polkadot trading”, “crypto technical analysis”, “altcoin strategy”, “defi tokens”],

“sentiment”: “bearish”

}

“`

Key Metrics

| Price | 3.8230 USDT |

| 24h Change | -1.92% |

| 24h Volume | 10248420.98 |

| RSI(14) | 31.20 |

| SMA20 / SMA50 | 3.86 / 3.88 |

| Daily Volatility | 3.25% |

Polkadot — 1h candles, 7D window (SMA20/SMA50, RSI).