Sentiment: Neutral

“`json

{

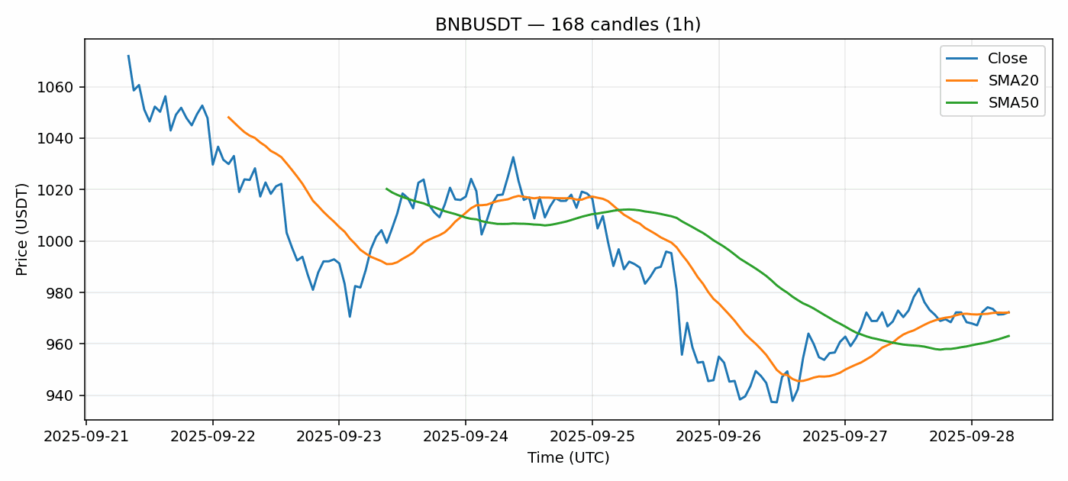

“analysis”: “BNB is currently trading at $972.33, showing modest gains of 0.28% over the past 24 hours. The price is essentially trading at the 20-day SMA ($972.21) while maintaining a comfortable cushion above the 50-day SMA ($963.08), indicating underlying strength in the medium-term trend. The RSI reading of 52 suggests the asset is in neutral territory with room for movement in either direction. Trading volume of $219 million appears healthy but not explosive, suggesting measured participation rather than speculative frenzy. The 3.17% volatility indicates relatively stable price action compared to typical crypto standards. Given the technical setup, I’d recommend watching for a decisive break above $980 with volume confirmation for long entries, while maintaining $960 as key support. Position sizing should remain conservative until we see clearer directional conviction.”,

“tags”: [“bnb analysis”, “crypto trading”, “technical analysis”, “binance coin”, “altcoin strategy”],

“sentiment”: “neutral”

}

“`

Key Metrics

| Price | 972.3300 USDT |

| 24h Change | 0.28% |

| 24h Volume | 218915201.78 |

| RSI(14) | 52.16 |

| SMA20 / SMA50 | 972.21 / 963.08 |

| Daily Volatility | 3.17% |

BNB — 1h candles, 7D window (SMA20/SMA50, RSI).