Sentiment: Bullish

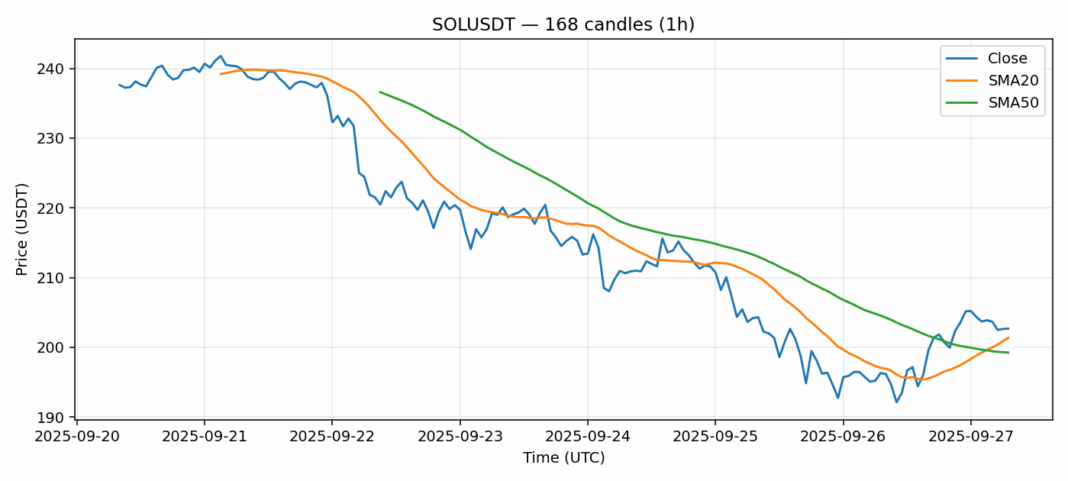

SOL is showing modest strength trading at $202.69, holding above both the 20-day SMA ($201.37) and 50-day SMA ($199.25). The 3.6% gain on over $1B in volume indicates genuine buying interest, not just a thin-market pump. The RSI at 55.93 is in a healthy neutral zone, leaving ample room for upward momentum before hitting overbought conditions. Current price action suggests consolidation above key moving average support, which is constructive for a potential leg higher. However, the 3.8% daily volatility warrants caution; traders should use tight stops. My advice: consider long entries on a confirmed break above $205 with a target of $215-220. Keep stops below the 50-day SMA around $197. The market structure remains cautiously optimistic, but watch for a volume drop which could signal a fakeout.

Key Metrics

| Price | 202.6900 USDT |

| 24h Change | 3.63% |

| 24h Volume | 1011245261.27 |

| RSI(14) | 55.93 |

| SMA20 / SMA50 | 201.37 / 199.25 |

| Daily Volatility | 3.80% |

Solana — 1h candles, 7D window (SMA20/SMA50, RSI).