Sentiment: Neutral

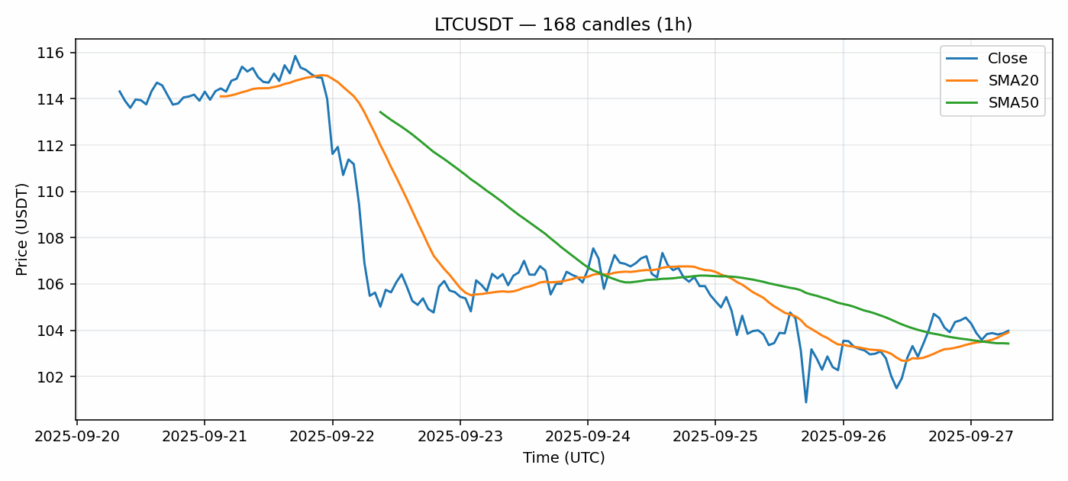

LTCUSDT is showing intriguing technical signals at the $104 level. The current price sits just above both the 20-day SMA ($103.91) and 50-day SMA ($103.43), indicating potential support consolidation. The RSI reading of 37 suggests Litecoin is approaching oversold territory, which historically presents buying opportunities for swing traders. While the 24-hour price change remains modest at +0.88%, the relatively high volatility of 2.85% indicates significant price movement potential. Volume appears healthy at $24.4 million, supporting current price levels. Traders should watch for a decisive break above $105 with increased volume as confirmation of bullish momentum. Consider scaling into long positions between $102-104 with stops below $100. The convergence of SMAs suggests we’re at a critical juncture – a breakdown below $102 could trigger further selling toward $95 support.

Key Metrics

| Price | 103.9800 USDT |

| 24h Change | 0.88% |

| 24h Volume | 24454992.30 |

| RSI(14) | 37.37 |

| SMA20 / SMA50 | 103.91 / 103.43 |

| Daily Volatility | 2.85% |

Litecoin — 1h candles, 7D window (SMA20/SMA50, RSI).