Sentiment: Bullish

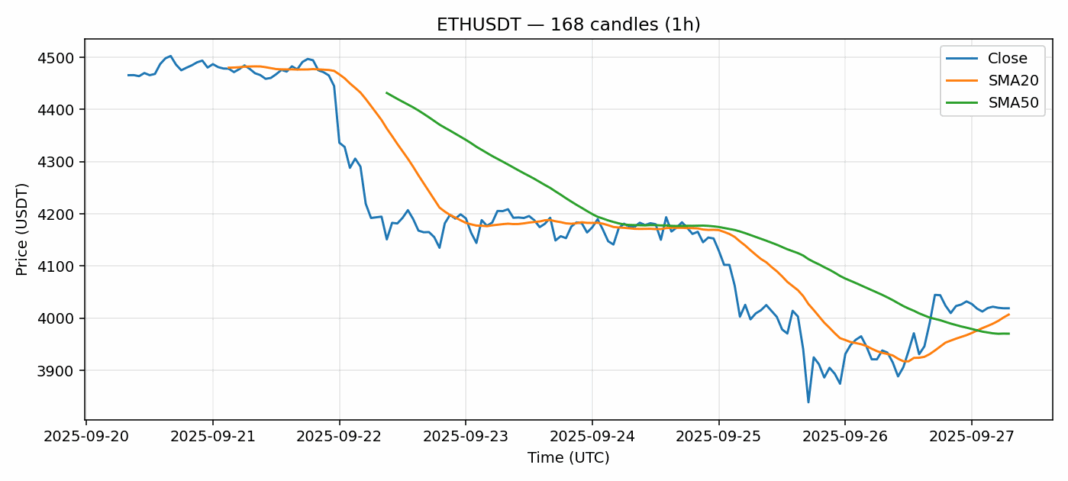

ETH is showing resilience trading at $4,019, holding above the critical 20-day SMA at $4,007. The 2.41% gain on substantial $1.85B volume suggests genuine buying pressure, not just a dead cat bounce. The RSI at 35.57 indicates ETH is approaching oversold territory, which often precedes a momentum shift. With price trading above both the 20 and 50-day SMAs, the near-term structure remains constructive. However, the elevated 2.85% volatility reading warrants caution for leveraged positions. My advice is to consider scaling into longs on any dip towards the $3,970 SMA50 support level, using a stop-loss below $3,920. A decisive break and close above $4,100 would confirm bullish continuation towards the $4,200-$4,300 resistance zone. Risk management is key here given the volatility.

Key Metrics

| Price | 4019.0200 USDT |

| 24h Change | 2.41% |

| 24h Volume | 1854841552.36 |

| RSI(14) | 35.57 |

| SMA20 / SMA50 | 4006.91 / 3970.35 |

| Daily Volatility | 2.85% |

Ethereum — 1h candles, 7D window (SMA20/SMA50, RSI).