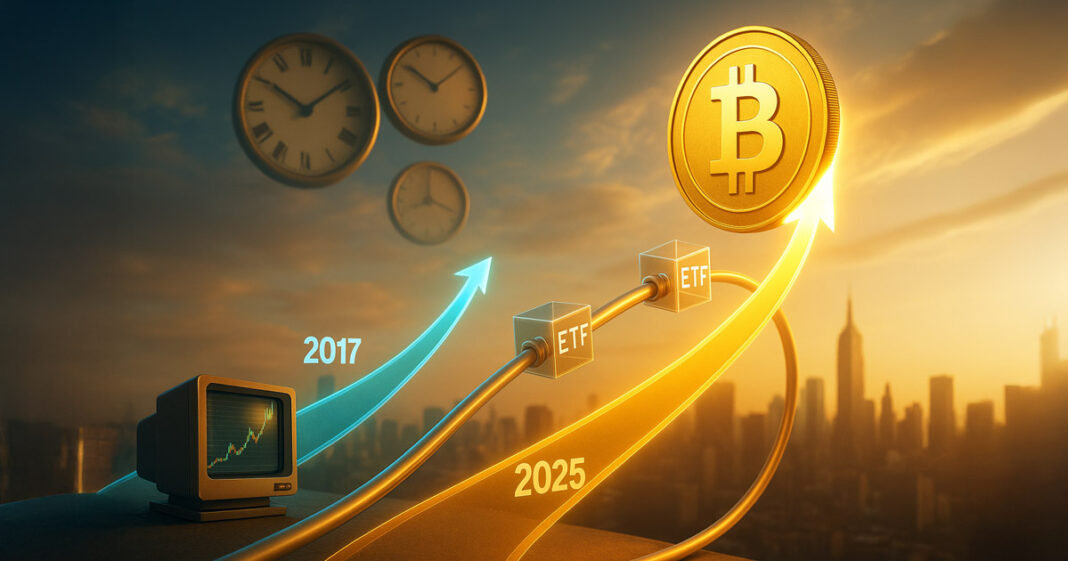

Bitcoin’s price trajectory in the third quarter of 2025 is demonstrating remarkable parallels with its historic 2017 market cycle. Throughout the summer months, the cryptocurrency established a consolidation range between $100,000 and $115,000, with technical analysis indicating a solid foundation forming around the $107,000 support level. This price action mirrors the pattern observed during 2017’s mid-cycle correction, where Bitcoin similarly consolidated before initiating its next major upward movement.

Market analysts note that the current technical structure shares multiple characteristics with the 2017 cycle, including similar trading volume patterns and momentum indicators. The recent price dip, while concerning to some investors, appears consistent with historical mid-cycle behavior where temporary pullbacks have typically preceded significant rallies.

Technical analysts point to several key indicators suggesting potential for substantial upward movement. The consolidation phase has allowed for healthy market digestion of previous gains while building energy for the next potential breakout. Historical precedent suggests that such patterns, when they mirror previous cycles, can lead to exponential price increases.

While past performance doesn’t guarantee future results, the striking similarities between current market behavior and the 2017 cycle have prompted renewed discussion about Bitcoin’s potential to reach the $200,000 threshold. Market participants are closely monitoring volume confirmation and breakout patterns that could signal the beginning of the next major upward phase in Bitcoin’s market cycle.