Sentiment: Bullish

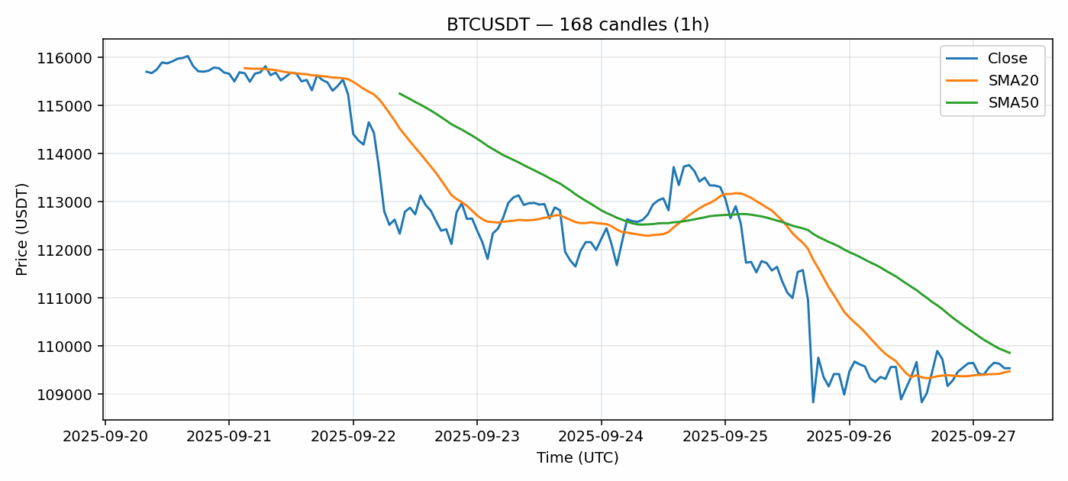

Bitcoin is showing resilience at the $109,500 level with a modest 16.6% 24-hour gain. The price currently trades just above the 20-day SMA ($109,477) but remains below the 50-day SMA ($109,861), indicating near-term support but medium-term resistance overhead. The RSI reading of 40 suggests we’re approaching oversold territory, which could provide a springboard for upward momentum if buying pressure emerges. Volume remains healthy at $1.34B, supporting the current price action. The relatively low volatility reading of 1.47% suggests consolidation is occurring. Traders should watch for a decisive break above the 50-day SMA for confirmation of bullish continuation. Current strategy favors buying dips toward $108,000 with stops below $107,500, targeting $112,000 resistance. The market appears to be building energy for its next significant move.

Key Metrics

| Price | 109541.3500 USDT |

| 24h Change | 0.17% |

| 24h Volume | 1344722741.57 |

| RSI(14) | 40.07 |

| SMA20 / SMA50 | 109477.11 / 109861.35 |

| Daily Volatility | 1.47% |

Bitcoin — 1h candles, 7D window (SMA20/SMA50, RSI).