Sentiment: Bullish

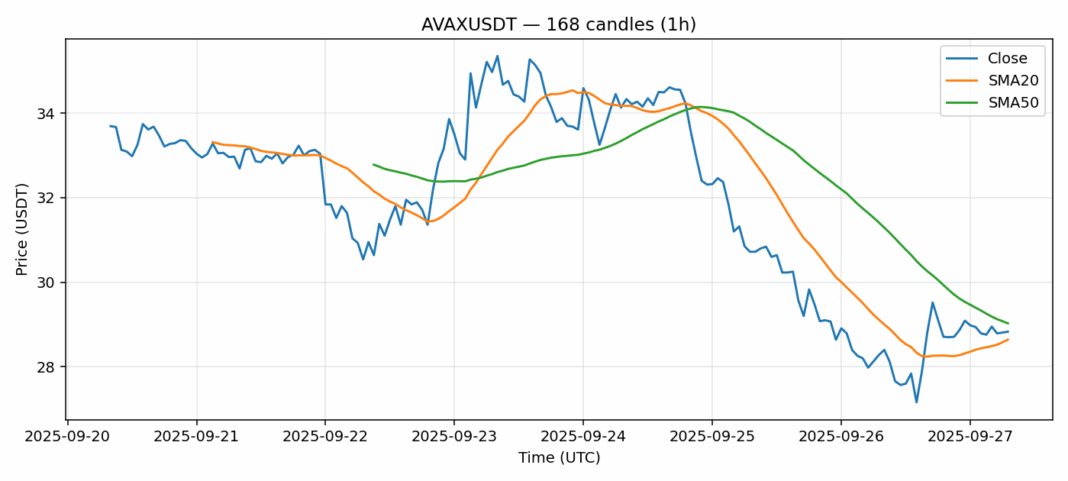

AVAX is showing interesting technical dynamics at the $28.83 level. The asset has posted a modest 2.38% gain over 24 hours, but more importantly, the RSI reading of 32 indicates significant oversold conditions. This often precedes a potential reversal or bounce. Currently trading slightly above the 20-day SMA ($28.64) but below the 50-day SMA ($29.03), AVAX appears to be testing key moving average support. The elevated volatility near 6% suggests traders should expect continued price swings. Volume remains healthy at $158 million, indicating sustained market interest. My trading advice would be to watch for a confirmed break above the $29.50 resistance level for long entries, with stops below $27.50. The oversold RSI combined with price holding above the 20-SMA suggests limited downside from current levels, making risk-reward favorable for cautious longs.

Key Metrics

| Price | 28.8300 USDT |

| 24h Change | 2.38% |

| 24h Volume | 158708054.86 |

| RSI(14) | 32.12 |

| SMA20 / SMA50 | 28.64 / 29.03 |

| Daily Volatility | 5.94% |

Avalanche — 1h candles, 7D window (SMA20/SMA50, RSI).