Sentiment: Neutral

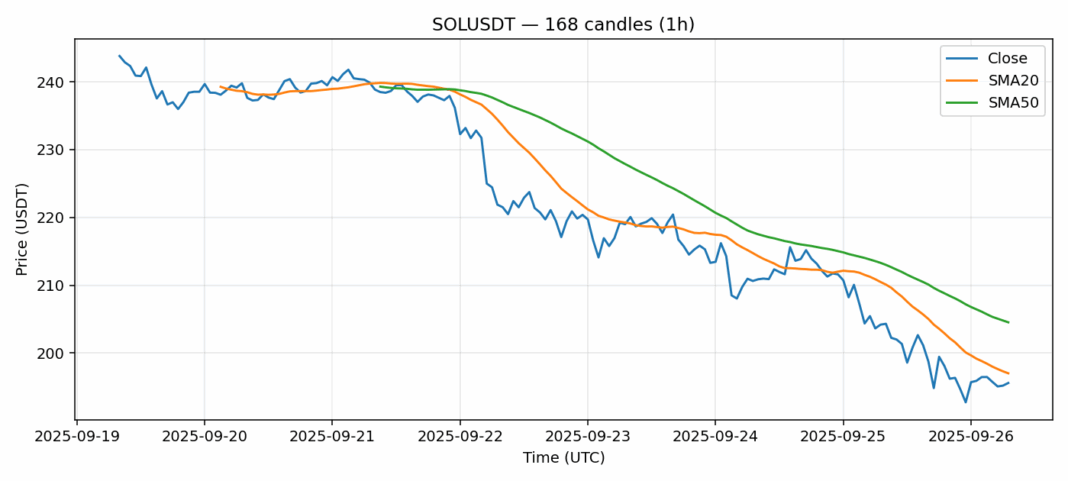

SOL is currently trading at $195.59, showing moderate weakness with a 3.85% decline over the past 24 hours. The price sits just below the 20-day SMA ($197.02) and notably under the 50-day SMA ($204.53), indicating potential resistance ahead. With an RSI of 52.18, momentum appears neutral-leaning, neither overbought nor oversold. The $2.4B+ daily volume suggests healthy participation, though the 3.57% volatility reading implies choppy conditions. Key support lies around $190-192; a break below could trigger further selling toward $180. For traders, consider short-term range plays between $192-$200 with tight stops. Longer-term positions should wait for a decisive break above the 50-day SMA with volume confirmation. Risk management is crucial given the elevated volatility – reduce position sizes and avoid chasing moves in this uncertain technical setup.

Key Metrics

| Price | 195.5900 USDT |

| 24h Change | -3.85% |

| 24h Volume | 1256422622.21 |

| RSI(14) | 52.18 |

| SMA20 / SMA50 | 197.02 / 204.53 |

| Daily Volatility | 3.57% |

Solana — 1h candles, 7D window (SMA20/SMA50, RSI).