Sentiment: Neutral

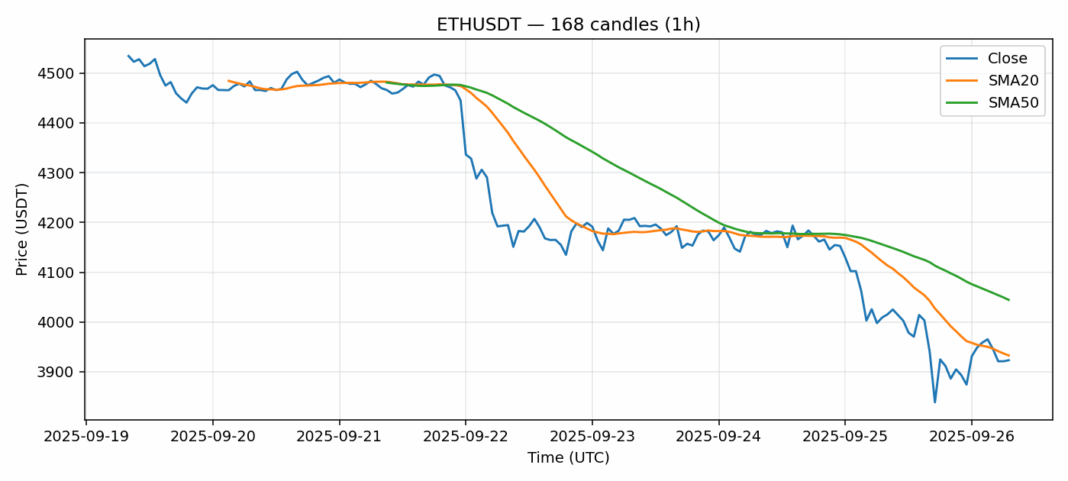

ETH is showing modest weakness at $3,923, trading just below the 20-day SMA of $3,933. The 24-hour decline of 1.84% suggests short-term profit-taking, though volume remains robust at over $3.1 billion, indicating sustained interest. The RSI at 63.57 leans bullish but isn’t overbought, leaving room for upward movement. However, ETH sits significantly below the 50-day SMA of $4,044, highlighting a key resistance level that must be reclaimed for a stronger bullish case. The 2.69% volatility is manageable for swing trading. My advice: Wait for a decisive break above the 20-day SMA with strong volume to confirm a push toward $4,050. A failure to hold $3,900 could see a test of lower support near $3,850. Use tight stops if entering long positions here.

Key Metrics

| Price | 3923.2000 USDT |

| 24h Change | -1.84% |

| 24h Volume | 3157831152.05 |

| RSI(14) | 63.57 |

| SMA20 / SMA50 | 3932.85 / 4044.43 |

| Daily Volatility | 2.69% |

Ethereum — 1h candles, 7D window (SMA20/SMA50, RSI).