Cipher Mining Technologies Inc. has significantly increased its convertible senior notes offering to $1.1 billion, reflecting strong market confidence following the company’s landmark $3 billion agreement with technology giant Google. The expanded debt offering represents a substantial upward revision from initial plans, signaling robust investor appetite for the bitcoin miner’s growth strategy.

The development comes just days after Cipher announced a comprehensive partnership with Google that includes both infrastructure support and financial backing for the miner’s expansion initiatives. Market response has been immediately positive, with Cipher’s stock (CIPHER) experiencing notable gains during after-hours trading as institutional investors demonstrated heightened interest in the company’s prospects.

Convertible notes offer holders the option to convert debt into company stock at predetermined prices, typically appealing to investors seeking exposure to potential equity upside while maintaining fixed-income security. The successful upsizing of Cipher’s offering suggests that financial markets view the Google partnership as a transformative development that enhances the miner’s competitive positioning.

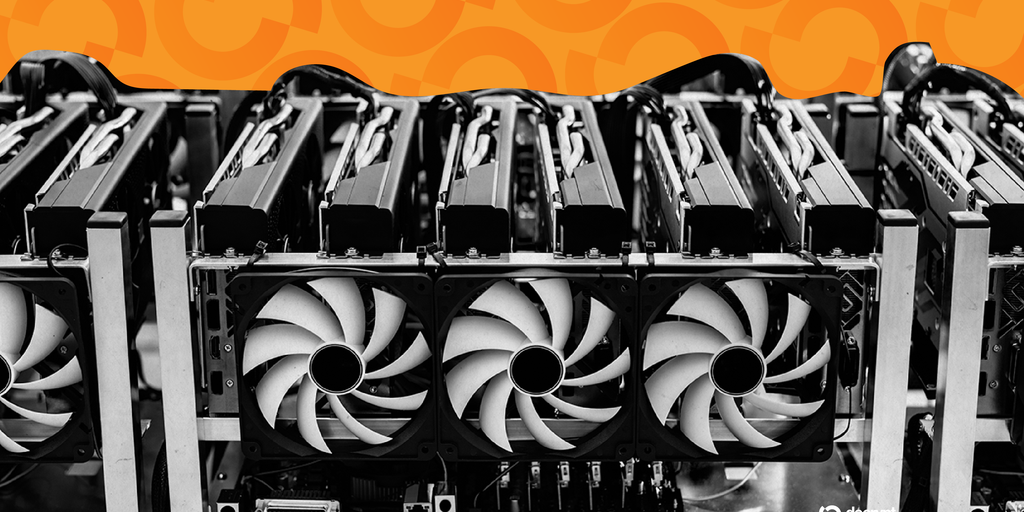

Industry analysts note that the additional capital will likely accelerate Cipher’s mining capacity expansion and technological infrastructure development. The company operates multiple mining facilities across North America and has been strategically increasing its hash rate capacity throughout 2024. This substantial capital infusion positions Cipher to potentially capture greater market share during the next anticipated bitcoin network difficulty adjustment.

The transaction was managed by a consortium of leading investment banks, with pricing terms reflecting favorable market conditions for established bitcoin mining operations with proven operational track records.