Sentiment: Neutral

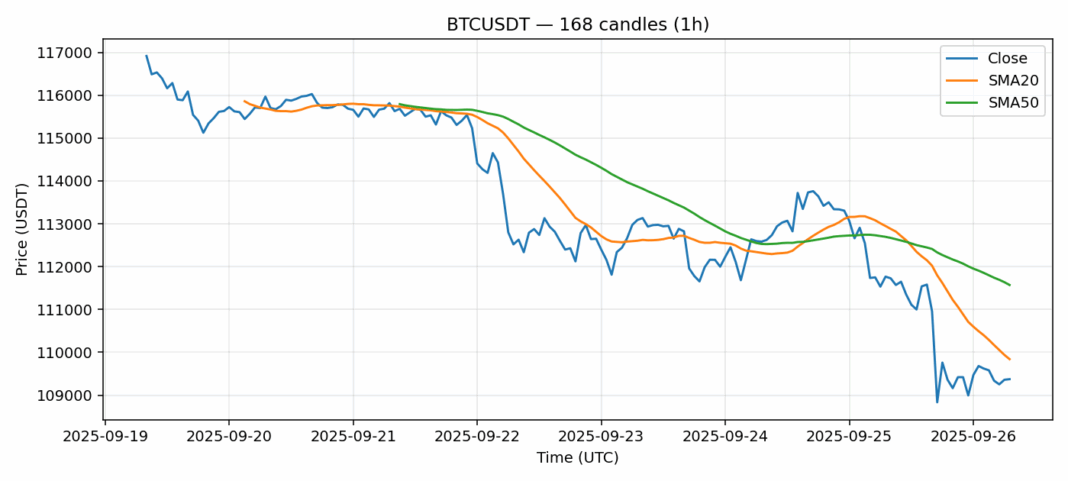

Bitcoin is currently trading at $109,360, showing a slight pullback of nearly 2% over the past 24 hours. The price is hovering just below the 20-day SMA ($109,840) but remains significantly above the 50-day SMA ($111,570), indicating underlying strength despite short-term weakness. The RSI reading of 57.85 suggests the asset is in neutral territory, neither overbought nor oversold, providing room for movement in either direction. Trading volume remains robust at over $2.1 billion, signaling sustained market interest. The moderate volatility of 1.4% suggests relatively stable conditions. For traders, this presents a potential accumulation zone. Consider setting buy orders near the $108,000 support level with a stop-loss around $106,500. A decisive break above the 20-day SMA could target resistance at $112,000. Monitor volume closely – decreasing volume on pullbacks would suggest the downtrend is losing steam.

Key Metrics

| Price | 109360.0000 USDT |

| 24h Change | -1.95% |

| 24h Volume | 2136563353.86 |

| RSI(14) | 57.85 |

| SMA20 / SMA50 | 109840.96 / 111571.71 |

| Daily Volatility | 1.42% |

Bitcoin — 1h candles, 7D window (SMA20/SMA50, RSI).