Sentiment: Bearish

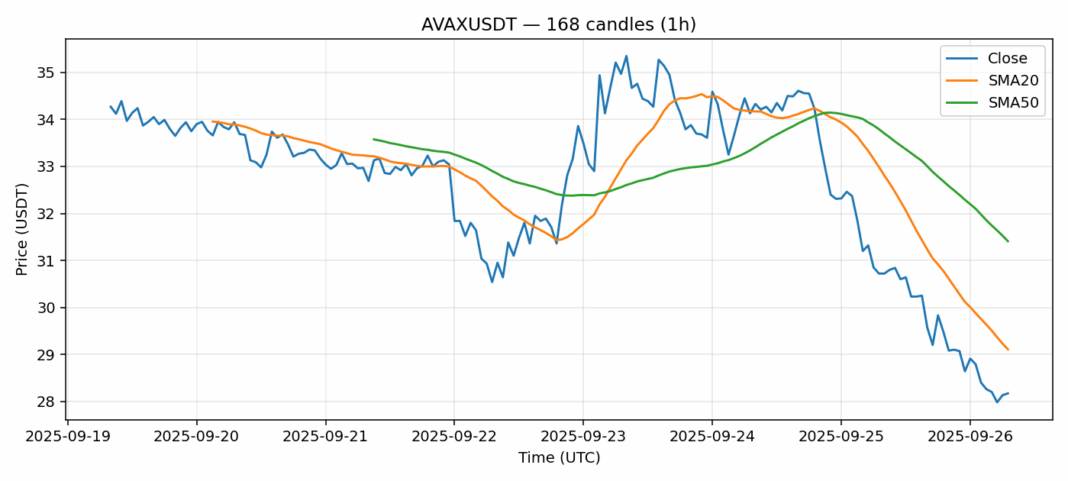

AVAX is showing significant weakness after an 8.8% decline over the past 24 hours, now trading at $28.17 below both its 20-day SMA ($29.11) and 50-day SMA ($31.41). The RSI reading of 34 indicates oversold conditions, suggesting potential for a short-term bounce, but the breach of key moving averages confirms the bearish momentum. Trading volume remains elevated at $193 million, indicating strong seller participation. The high volatility reading of 5.5% suggests continued price swings ahead. Traders should watch for support around the $27.50 level – a break below could trigger further declines toward $25. Consider short positions on any rallies toward $29.50 resistance with tight stops above $30. Long-term investors might scale in below $27 if momentum stabilizes, but wait for RSI recovery above 40 before adding significant exposure.

Key Metrics

| Price | 28.1700 USDT |

| 24h Change | -8.80% |

| 24h Volume | 193306506.13 |

| RSI(14) | 34.15 |

| SMA20 / SMA50 | 29.11 / 31.41 |

| Daily Volatility | 5.51% |

Avalanche — 1h candles, 7D window (SMA20/SMA50, RSI).