Sentiment: Bearish

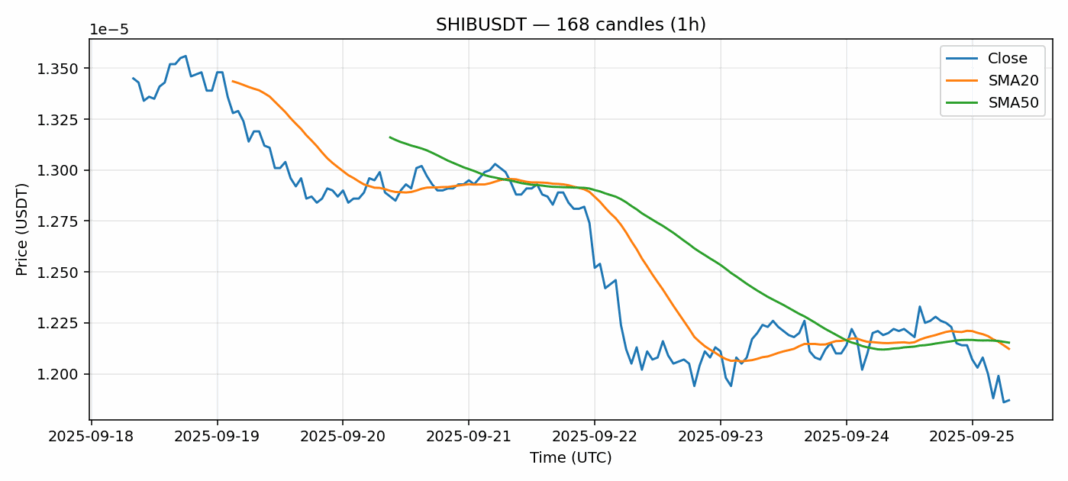

SHIB is showing concerning technical signals with the price currently trading at $0.00001187, below both the 20-day SMA ($0.00001212) and 50-day SMA ($0.00001215). This indicates sustained bearish pressure. The RSI reading of 22.67 suggests SHIB is deeply oversold, which typically precedes a potential bounce, but we haven’t seen capitulation volume yet. The 24-hour trading volume of $12.8 million appears relatively low for such extreme RSI levels, indicating lack of strong buying interest. Volatility remains elevated at 2.4%, creating risky trading conditions. My advice: wait for confirmation of a reversal pattern before entering long positions. Aggressive traders might consider small longs with tight stops below recent lows, but the safer play is to wait for RSI to recover above 30 and price to reclaim the 20-day SMA. Risk management is crucial given the high volatility.

Key Metrics

| Price | 0.0000 USDT |

| 24h Change | -2.71% |

| 24h Volume | 12859469.96 |

| RSI(14) | 22.67 |

| SMA20 / SMA50 | 0.00 / 0.00 |

| Daily Volatility | 2.40% |

Shiba Inu — 1h candles, 7D window (SMA20/SMA50, RSI).