Sentiment: Bullish

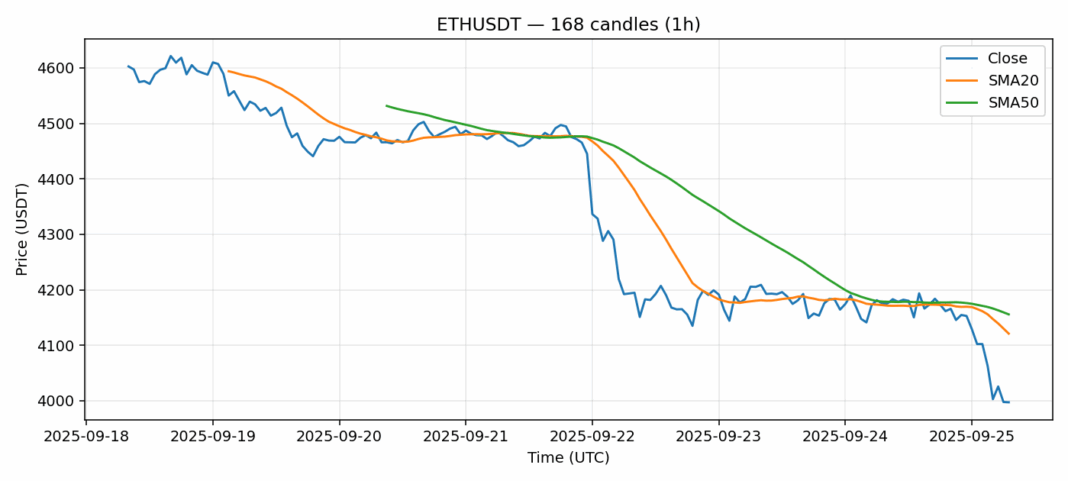

ETH is showing extreme oversold conditions with RSI at 13.96, well below the traditional 30 oversold threshold. While the price has dropped 4.4% to $3,997, trading below both the 20-day SMA ($4,121) and 50-day SMA ($4,155), the severely depressed RSI suggests a potential reversal opportunity. Volume remains robust at over $2 billion, indicating sustained market interest despite the downturn. The current volatility reading of 2.17% presents favorable risk-reward conditions for contrarian positions. Traders should consider scaling into long positions with tight stops below $3,950, targeting initial resistance at the 20-day SMA. The extreme RSI reading historically precedes significant bounces in ETH, though confirmation requires a break above $4,050. Risk management remains crucial given the broader market uncertainty.

Key Metrics

| Price | 3997.2200 USDT |

| 24h Change | -4.41% |

| 24h Volume | 2013448883.86 |

| RSI(14) | 13.96 |

| SMA20 / SMA50 | 4121.04 / 4155.70 |

| Daily Volatility | 2.17% |

Ethereum — 1h candles, 7D window (SMA20/SMA50, RSI).