Sentiment: Bearish

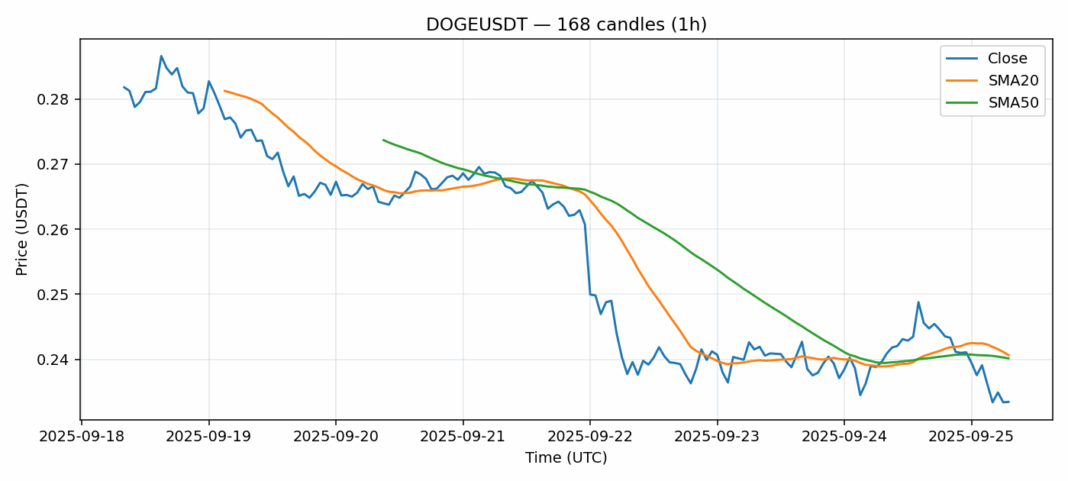

DOGEUSDT is showing significant oversold conditions with an RSI of 17.45, deep into traditional oversold territory below 30. The price at $0.23345 sits below both the 20-day SMA ($0.2406) and 50-day SMA ($0.2401), indicating bearish momentum in the short to medium term. The 2.22% decline over 24 hours coupled with elevated volatility of 3.63% suggests continued selling pressure. However, the substantial 24-hour volume of $380 million indicates strong market participation, potentially signaling capitulation or accumulation near these levels. Traders should watch for RSI divergence and potential bounce plays from oversold conditions. Consider scaling into long positions with tight stops below $0.2300, while aggressive sellers might wait for any relief rally toward the SMA cluster around $0.2400-0.2410 for better short entries. Risk management is crucial given the elevated volatility.

Key Metrics

| Price | 0.2334 USDT |

| 24h Change | -2.22% |

| 24h Volume | 380604200.34 |

| RSI(14) | 17.45 |

| SMA20 / SMA50 | 0.24 / 0.24 |

| Daily Volatility | 3.63% |

Dogecoin — 1h candles, 7D window (SMA20/SMA50, RSI).